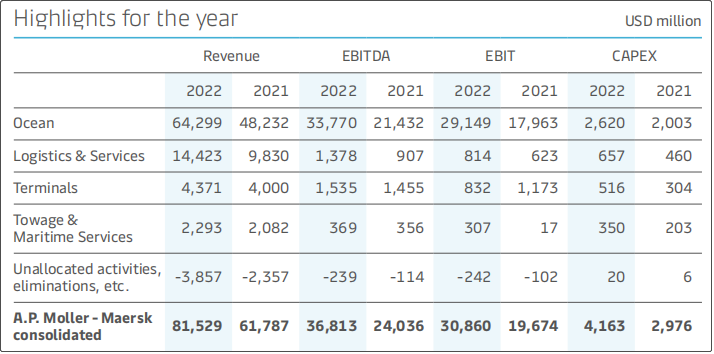

On February 8th, Masisky announced its strong 2022 annual results with a total revenue of US $ 81.529 billion and a pre -interest tax (EBIT) of US $ 30.86 billion.

However, the company's outlook for 2023 is lower than the general expectations, and the freight rate will be weak in the second half of this year. It believes that the spot freight rate is currently stabilizing. It is expected that the contract price in 2023 will negotiate at a level close to the spot price, thereby reducing its average freight rate.

In addition, with the normalization of retailers, the freight volume may be recovered in the second half of the year, but because a wave of new ships will be launched in the second half of 2023 and 2024, the freight rate will face the pressure brought by the increase in capacity.

Patrick Jany, chief financial officer of Maski, said: "This means that the profitability of the shipping business in the second half of this year is low or very low." Maski predicts that in his performance report Compared with 2022, a significant decrease of 25.8 billion to 28.8 billion US dollars.

• The performance of the whole year and fourth quarter of 2022

According to reports, Maski's total revenue in 2022 was US $ 81.529 billion, an increase of 32%compared with US $ 61.787 billion in 2021; EBIT profit (EBIT) was US $ 30.86 billion, an increase of 57 compared with 19.674 billion US dollars in 2021 in 2021 %; Net profit was $ 29.3 billion, an increase of 62.7%year -on -year.

The fourth quarter revenue was US $ 17.82 billion, a decrease of 4%compared with US $ 18.506 billion in 2021; EBIT was US $ 5.122 billion, a decrease of 22.8%compared with US $ 6.634 billion in 2021.

Most of the huge profits of Masky came from its shipping business. Maritime revenue increased from US $ 48.2 billion in 2021 to $ 64.4 billion, mainly driven by the increase in freight in the first three quarters. The decrease in profitability in the fourth quarter was mainly due to the weakness of consumer demand that caused greatly adjusting inventory, plus inflation pressure, which led to a decline in transport and freight.

The company's average shipping cost in 2022 was $ 4628/Feu, an increase of 39.5%year -on -year; and the average shipping cost of the fourth quarter was $ 3869/Feu, slightly lower than the $ 4009/Feu in the same period of 2021.

• European and American import declines exceed expectations

According to the Maski report, its total freight volume in 2022 was 11.924 million FEU, a decrease of 9%from 13.089 million FEUs in 2021. Among them, the freight volume in the fourth quarter was 2.807 million FEU, a decrease of 14%from the 3.263 million FEU in the same period in 2021, and the quarter -quarter decreased by 7%.

Matsky CEO Vincent Clerc acknowledged that the company's performance in the fourth quarter was inferior to the entire industry. "This is because we have an open market for the east -west trade, especially in the vertical markets such as retail, lifestyle and technology. These industries are our market with a large growth, but they are most affected by inventory adjustments."

ClerC explained: "Although we have previously expected that the shipping price of sea transportation in the second half of 2022 will be significantly normal, at the same time, the decline in imports exceeds expectations. As large retailers and lifestyle brands adjust inventory, from Asia The import volume to North America and Europe dropped by about 20%. "

"The import volume of North America and Europe is now below the average level before the epidemic, which seems to be caused by the adjustment of inventory." With the progress of 2023, this adjustment should be lifted. "We predict that in the second half of the year (assuming the consumption level remains unchanged), we will see that the volume of freight in the supply chain will rise to the level of actual consumption, and it will not decrease because of inventory adjustment."

• Outlook on the shipping market in 2023

Matsky said that global GDP growth is expected to slow in 2023, and the global sea transport container market growth will be between -2.5%and+0.5%. Matsky is expected to grow at the same time as the market.

In terms of contract freight, inventory adjustment and decline in imports have caused the spot freight rate to plummet, and this impact is seriously affected the contract freight market. CLERC said that during the annual contract negotiation, the decline in spot prices will naturally affect the entire industry. It is expected that the average contract price of 2023 will eventually move closer to the current spot freight rate.

CLERC said that in 2023, Mascean will continue to transport 70%of its long -distance capacity in the form of annual or multi -year contracts, and confirmed that so far, Maski's about half of the contract has been signed, mainly Asian and European customers. Although the price is low, the price is low. There are many, and the cross -Pacific contract will be signed in March and April.

When it comes to the decision to terminate the 2M alliance with MSC, ClerC said that the synergy effect brought by the merger has declined significantly, and at the same time, the non -collaborative effect has increased. "We need to obtain and maintain the strict control of the service level provided. In order to realize the wishes of global integrators, this is very important."

He said: "These goals cannot be achieved in the alliance structure." It also excluded the possibility of Master's cooperation with another ship sharing group. CLERC said: "We have a large -scale and competitive cost foundation that can operate independently and meet customer expectations."

In addition, CLERC also mentioned that the operating costs of Maski rose sharply. Last year, the total operating expenses of the shipping business alone increased by 14%to $ 30.6 billion, and the revenue in the fourth quarter fell $ 1.3 billion, but the cost was only $ 26 million. Therefore, Maski will work hard to reduce costs to avoid severe decline in operating performance.

Previous:European line freight fell below the $ 1,000 mark! Shipping company warning: market or new price war

Next:Sudden! Two episodes collided, ships and containers were severely damaged