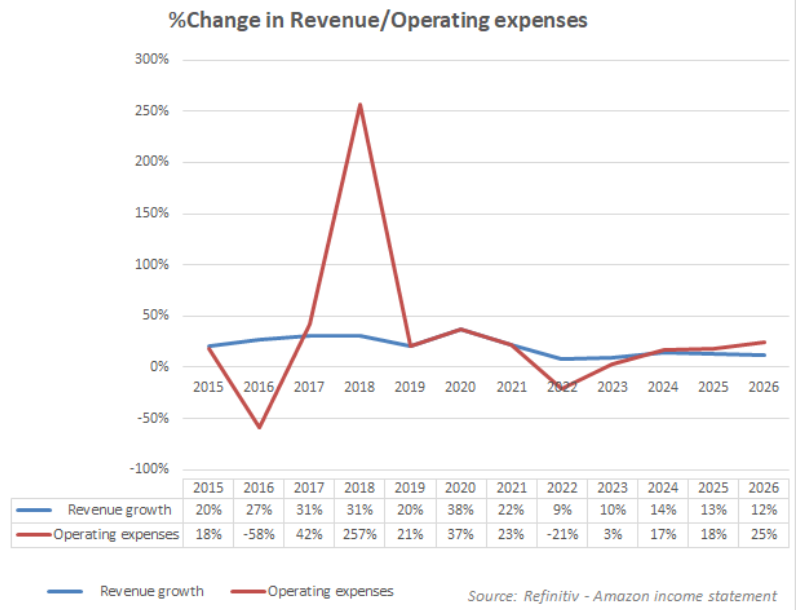

As the epidemic has eased, the demand for remote work of consumers has decreased, and online shopping needs have ushered in cooling. According to Amazon Chief Financial Officer, the company also faces the problem of inflation. The increase in power and fuel costs exceeds the revenue growth rate, especially after expanding the large -scale facilities, and Amazon Network Services (AWS) and the Amazon Network Services (AWS) and Its advertising business fills this shortage.

The three -year survey of EU antitrust regulatory agencies also came to an end. Amazon was eventually exempted from paying a high fine of 10%of its global income. Inflation is still eased, but the risk of economic recession is still lurking outside, and the macroeconomic environment is still full of challenges. As far as Amazon is concerned, European workers' strikes and uncertain geopolitical conditions are also two other major environmental factors that hinder growth.

As far as growth is concerned, Amazon's earnings of 2022 may be relatively bleak. Analysts predict that due to the peak of holiday gift procurement in October, Amazon's revenue in the fourth quarter will increase to $ 145 billion, and the growth rate may slow down to 5.79%, as 14.70%and 2021 in the third quarter of 2022 and 2021 in 2021 Compared with 9.44%of the same period, it may become the lowest level in recent years. It is reported that Amazon's previous revenue forecast for the fourth quarter of 2022 set a $ 140 billion-$ 148 billion, an increase of 2%-8%year-on-year, and the official expectations were basically in line with this judgment.

At the market level, the income growth of Amazon's network services is expected to slow to 24.10%, and it will also usher in a low time. The online store business may have an increase of up to 905%, which is a successful ending in 2022, but the quarterly increase of the business line has decreased by 0.98%.

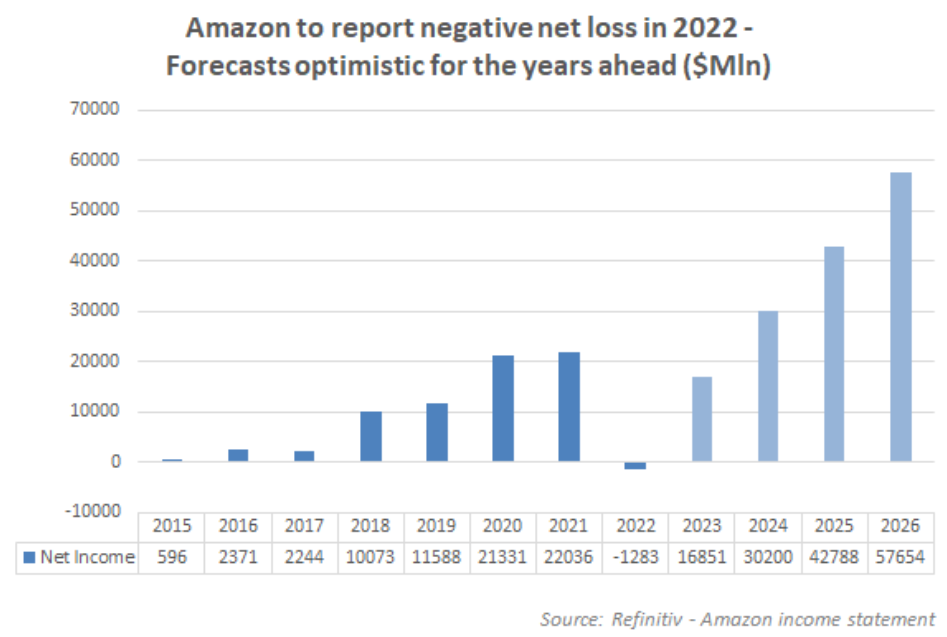

At the same time, although Amazon's operating costs will decrease by 26%, it is expected that its net loss will reach $ 1.2 billion for the first time in more than ten years. Among other profit indicators, Amazon's pre -tax profit may shrink by 28%, and its gross profit margin increased by 2.46%in 2021, while the gross profit margin increase in 2022 is expected to fall from 1.46%to 43%.

At the same time, earnings per share may further crack down on investors' confidence, and may fall to a low point over the years. Analysts said that as of 2022, Amazon may face a disappointing ending. SMEs occupy the vast majority of their user groups, and a year of turbulent year may be spent in 2023.

However, as a listed company, it has gone through three times of development and decline, including Internet bubbles. This retail giant has repeatedly proved that it can spend the storm safely in its 25 -year history.

In early 2023, Amazon CEO Andy Jessy announced the global layoff plan involving 18,000 people, more than the number of people rumored before, which made the market nervous. In the past two years, as the global market resumes routine operation, Amazon has also begun to seek higher cost benefits.

In terms of valuation indicators, Amazon's expected price -earnings ratio is 60 times, which is slightly higher than 50 times the historical level. It is more than twice that of other technology giants such as Netflix, Apple and Tesla, which indicates that investors have relatively high growth prospects.

Previous:The world's largest shipping alliance 2M announced the dissolution!

Next:Another large container ship in MSC is stranded! Interrupt sailing! The ship delay!