Fitch rating recently stated that in the future, container shipping will face greater challenges, and oil tankers and dry bulk shipping will remain stable, and the performance of the oil tanker may be the most eye -catching.

The main risks faced by the centralized sector include a more serious economic recession than expected. Although the Russian -Ukraine conflict has a negative impact on dry bulk shipping, it has pushed the oil transport sector. In addition to other interference factors that may affect the trade flow, geopolitical conflicts will continue to affect the market in 2023. It should be noted that if trade protectionism is rising, it may lead to changes in trade flow and restrict the needs of a few high profits or key products.

The International Maritime Organization (IMO) greenhouse gas (GHG) emissions strategy, short -term measures (EEXI and CII) for compulsory implementation in 2023, and EU marine emissions may affect the cost structure and income level of shipping companies in the short term and medium -term.

-Capyle-

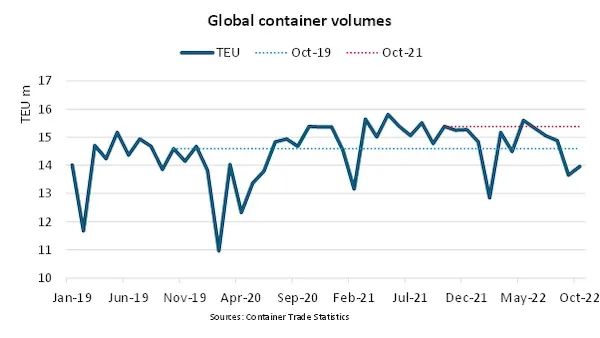

Data from BIMCO shows that in October 2022, the export volume of global containers decreased by 9.3%year -on -year and a 4.3%decrease from October 2019. Fitch data shows that the transport volume of containers increased by 7%in 2021. It is expected to increase by about 1%in 2022, and it will increase by 2.5%in 2023.

It is expected that the growth rate of transportation in 2022 will exceed the demand growth rate of 3.6 percentage points. By 2023, it will increase to more than 5 percentage points.

-Oil transportation-

The demand growth rate of crude oil wheels in 2023 will be similar to 2022. Petroleum consumption in 2022 rose from 96 million barrels/day in 2021 to 100 million barrels/day. International energy institutions predicted that oil consumption in 2023 would rise to 102 million barrels per day. Although the growth rate of demand in 2023 declines, the increase in the number of tons of oil exports of Russia will partially the impact of the slowdown of the growth rate.

-Disperse-

In 2023, the demand for dry bulk shipping is expected to be the same as in 2022. Iron ore, coal and food trade are affected by the economic situation, and it is expected to remain stable.

The number of orders for dry cargo ships and tankers remain at a historical low. Among them, the order volume of dry loose ships is close to 7%of the existing capacity, and the tanker is 4%. The EEXI and CII regulations implemented in January 2023 may cause some ships to fail to meet the standards, and the capacity will be further reduced.

Previous:Do you know the container installation cabinet?

Next:Large -scale ship