Following "Breaking 7" in May, the renminbi has continued to weaken recently. Data show that on June 28, the exchange rate of the offshore RMB to the US dollar fell below 7.24, 7.25 and 7.26. After seven months, the yuan broke 7.26 again!

The fluctuations in the exchange rate have attracted the attention of many cross -border e -commerce sellers and foreign trade enterprises, and even industry people believe that the RMB may be entering a new round of depreciation cycle. If the overseas business denomination unit is the US dollar, the depreciation of the renminbi will have a positive effect on the exchange income of foreign trade enterprises, and the profit margin of cross -border sellers will increase in the short term. However, there is uncertainty in exchange rate fluctuations. Under the general trend of global demand shrinkage and slowing foreign trade growth, sellers and foreign trade enterprises need to pay close attention to changes in export trade and monetary policy to adjust the response strategy.

01

RMB against the US dollar exchange rate decreases

"The US dollar exchange rate is about to return to the pinnacle of recent years." A senior seller lamented. On June 28, both the exchange rate of the coast and offshore RMB fell off the US dollar and set a low point since November 2022. The shore RMB fell off the barrier to 7.2486, a drop of nearly 300 points; the offshore RMB's exchange rate against the US dollar fell below the 7.23, 7.24 and 7.25 mark on June 28, which also refreshed a new low since mid -November 2022.

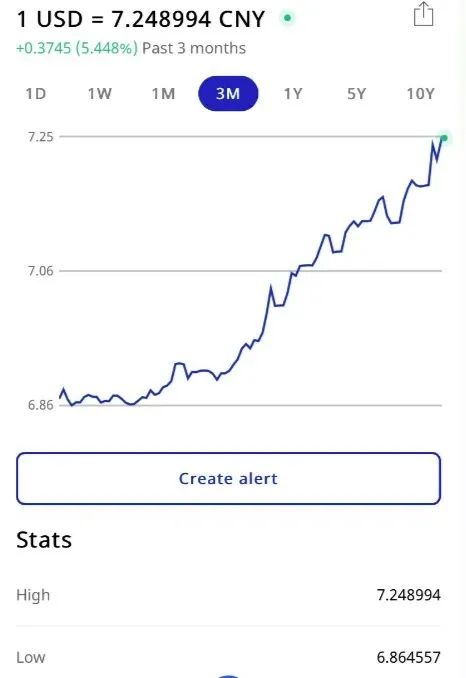

(In the past three months, the exchange rate of the RMB against the US dollar, the screenshot is from xe.com)

According to Hugo's cross -border understanding, the recent RMB exchange rate of the US dollar has continued to decline. After the opening on the morning of June 21, the exchange rate of the RMB against the US dollar fell more than 200 base points; the offshore RMB's 7.2 yuan mark was lost in the US dollar exchange rate, and it was the first time since November 2022. Since the beginning of this year, the exchange rate of the RMB against the US dollar has fallen by about 4%, and the exchanges of the offshore RMB have fallen by about 4.5%.

For the reasons for the lower exchange rate of the RMB against the US dollar, some analysts believe that it is mainly the pressure comparison pressure brought by the appreciation of the US dollar and the market's "expected" for the market for the Sino -US economic performance. Economic data in May shows that as the base effect fades, some indicators have slowed down, and even declined. For example The kinetic energy also weakened. Considering factors such as weak external demand, some institutions have successively adjusted their predictions on the Chinese economy. For example, Goldman Sachs lowered the 2023 Chinese GDP forecast from 6%to 5.4%. The GDP forecast is 5.2%. In the first quarter, many international institutions adjusted the Chinese GDP forecast in 2023 to more than 6%.

Liu Mingyang, CEO of Yiwu Ouchi Import and Export Co., Ltd., said to Hugo Cross -border that the company's overall exports have increased by about 40%in the near future, and the decline in the exchange rate of the RMB against the US dollar has a positive impact on the increase in profits. The impact of exchange rates on its export orders may be 3%to 5%. It is also reported that after the RMB accelerated depreciation, overseas customers also accelerated. Liu Mingyang believes that the overall data of exports is rising, but small and medium -sized enterprises still have a lot of pressure, and the exports of some products have a downward trend. In his opinion, the growth of profit or single volume cannot only look at the exchange rate. Enterprises should dig a larger digging. The growth of growth, with the help of cross -border e -commerce and big data to find the cost -effective products needed for the market.

02

Multi -path reduces exchange rate risk

The exchange rate fluctuations have uncertainty. For the recent decline in the exchange rate of the RMB against the US dollar, cross -border e -commerce companies and foreign trade enterprises must not only understand their short -term favorable side, but also pay attention to avoiding foreign exchange risks. FBA freight

Pet selling Tianyuan pet products is mainly based on overseas markets, and is mainly based on US dollar quotations and settlement. According to its 2022 annual report, the proportion of company's overseas sales in 2022 accounted for about 62.94%of operating income.

Regarding the problem of exchange rate fluctuations, Tianyuan Pet pointed out that because the cost side of the company's overseas sales part is mainly used for RMB, the exchange rate fluctuation from the quotation to the confirmation of the income period will affect the company's gross profit level. The exchange rate fluctuations during the period will cause the company to generate exchange profit or loss. At this stage, the depreciation of the renminbi has a certain degree of positive impact on the company's export business, but there is uncertainty in the exchange rate fluctuations. The company will actively and timely pay attention to changes in international exchange rates and seek multiple channels to reduce the operating risks caused by exchange rate fluctuations.

The overseas revenue of the supply chain service provider Oriental Jiasheng accounted for a large number of overseas revenue. According to Dongfang Jiasheng's 2022 financial report, its overseas revenue was 1.59 billion yuan, accounting for 56.49%of the total revenue. When answering investors' questions, Dongfang Jiasheng said that in the face of the new normal market normal of the exchange rate market that continues to fluctuate in the RMB exchange rate, the company actively agreed with customers to agreed with the customer's exchange rate change protection clauses in the contract, and on the other hand Arrangement, the impact of gentle exchange rate fluctuations on operating performance.

As the supply chain management business involves more import and export business, it is necessary to frequently receive foreign exchange. Oriental Jiasheng claims that it will continue to monitor the size of foreign currency transactions and foreign currency assets and liabilities of foreign currency, to maximize the risk of foreign exchange. For this reason, for this, Oriental Jiasheng mainly achieved the purpose of avoiding the risk of foreign exchange by signing a long -term foreign exchange contract.

Earlier, Shenzhen Big Sales Huacai Bai also said that the appreciation of the US dollar and the euro for the RMB is a good factor for the export industry. Hua Kai Bai collects different currencies in different sales destinations, and will also timely exchange back to the RMB without retaining a large amount of foreign currencies for a long time. At the same time, Huacai Bai's intelligent price adjustment system will timely adjust the price according to factors such as exchange rate fluctuations to ensure the competitiveness and profit margin of the product.

Zhu Qiucheng, general manager of Ningbo New Oriental Industry and Trade, said to Hugo cross -border that exchange rate fluctuations are the norm, but it has a greater impact on TOB companies. It is recommended that you continue to adhere to the principle of "risk neutral", actively manage foreign exchange risks, comprehensively adopt foreign exchange sets to preserve value -preserving value preservation. There are many ways to reduce the adverse effects of exchange rate fluctuations. When overseas customers sign orders, they can also explain in the signing agreement to explain the risks brought by the exchange rate changes by both parties, so that the two parties can maintain long -term cooperation.

Previous:Unverified Amazon accounts will be suspended on July 7

Next:What should Amazon sellers do if they encounter malicious competition on Prime Day?