Recently, the Amazon American Station issued an announcement that the new American consumer notification law is about to take effect. The bill requires third -party sellers to provide relevant information about its business. The seller needs to complete the verification. Otherwise, Amazon will stop the seller's account. The following is the announcement:

Inform Consumers Act Effective in the United States on June 27, 2023. The law stipulates that a large number of third -party sellers are obliged to provide information on their business and collect, verify and disclose information about its business on Amazon.

In order to ensure that customers and sellers can trust, Amazon has maintained and continued to innovate a strong process to collect and verify the seller's business information during the registration period and later. Although many of the processes are more complicated and effective than the basic requirements of the Informa Consumer Act, this new law requires that Amazon takes some additional steps to verify information related to large quantities.

Sellers may need to provide information about your business for verification, such as your name, the identity document issued by the government, company address, bank account information, work email address, work phone number and tax number. You may also need to prove that your information has been updated to the latest each year.

In addition, Amazon has updated the Amazon service business solution agreement to be consistent with new laws.

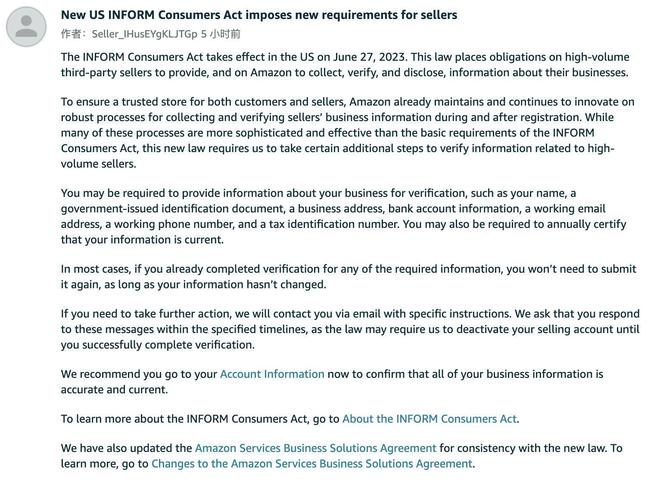

The following is the original screenshot of the announcement:

According to the law, starting from June 27, 2023, the online market covered by the Inform Consuamers Act must collect and verify the information about third -party consumer goods sellers, and disclose some of the major sellers about the major sellers to consumers. information.

The consumer informs the law to impose countless new obligations on the online market. The goal of the bill is to "prevent anonymous sellers from selling counterfeit products online and prevent organizational retail criminal groups from stealing items from stores and then resold these products online in batches. FBA shipping to USA

I. Online e -commerce platforms and a large number of third -party sellers will bear new obligations

The consumer notification law is mainly for the two market participants: the online market and third -party large -scale seller for consumers who sell consumer supplies for individuals, families, or family purposes. Invisible products, such as services and digital products, and products that are usually used for business purposes, are not within the coverage of the Convention.

The "online market" includes operating an individual or entity of consumer electronics or access platforms. Including major international platforms, online niche markets that cater to enthusiasts, small mature companies, startups and other online spaces other than these categories that promote third -party sales.

"Large quantitative third -party sellers" can be a third -party individual or entity. "In the past 12 months, there have been 200 or more new or unused consumer products discrete sales or transactions in the past 12 consecutive months. , Total income with a total income of 5,000 US dollars or more ".

2. Collecting, verifying and disclosing seller information is the core of consumer notification law

According to the bill, the three main compliance requirements of the online market are collecting, verifying and disclosing seller information -in order to achieve this in time, the market will need to establish a monitoring system.

collect

Within ten days after the seller eligible for the "large quantity" seller, the online market (such as Amazon) must collect the seller:

· Bank Information -Account or Cashier names issued by the market to sellers.

· Contact information -For individual sellers, it needs to provide its name. For non -individuals, it is necessary to provide valid ID issued by the government, which includes the name of the legal person, or the effective record or tax document issued by the government Essence

· Tax Number -Business Tax or Taxpayer Identification Number.

· Work email and phone number.

The online market must contact a large number of sellers at least once a year to confirm whether the required information must be updated. If the seller does not disclose the information they need within ten days, the online market must suspend the sales activities of the seller.

Verify

After collecting, the online market must verify seller information within ten days after receiving. "Verification" refers to the use of "one or more methods, enabling the online market to reliably determine that any information and files provided are effective. Individuals corresponding to the seller or representative of the seller are not stolen and unpatished. shipping cost

Disclose

The online market must be "clear and obvious" to consumers in the product Listing page (direct or via the hyperlink) or in the historical record of the order checkout process and the buyer's order history. A large amount of seller's information, including the seller:

· Name -The name of the individual seller, the company's company name or the name of the seller or the company operates in the online market.

· Actual address

· Contact Information -Including the current effective email address, phone number, or other direct electronic message transfer methods, allowing consumers to communicate directly and unhindered in a large number of sellers.

In addition to seller information disclosure requirements, the online market must also provide a report mechanism clearly and prominently to allow them to report to the online market to report any suspicious market activities on the Listing page of any large quantities of sellers.

Third, the influence on the seller's compliance

Consumers inform the law to prevent anonymous sellers from selling counterfeit products online and prevent organizational retail criminal groups from stealing items from stores and then sale online and protect consumers in these markets. logistics

In order to maintain compliance, the seller needs to consider a few key points in advance:

First, triggering compliance requires the sales volume of the seller rather than the scale.

Pay attention to the following sets of data: "Any 12 months in a row in the past 24 months", "200 times or more new or unused consumer goods discrete sales or transactions, the total income is $ 5,000 or more" " The annual income of more than 20,000 US dollars will trigger the disclosure requirements.

This means that the "strike" of Amazon's future account review is very large. Almost every shop that can feed himself cannot escape the fate of the first trial.

Secondly, for sellers who hold dozens or even hundreds of stores, due to the "not clean" of their registered information, the annual review will greatly increase the risk of stores and increase the cost of maintaining the store.

Previous:Amazon launched a flexible buyer installment payment function

Next:The ship company launched a price war? Expert: blandless