UPS plans to further reduce the related business of top customers in 2023, and Amazon has similar considerations.

Amazon is gradually building the logistics empire in order to better control the transportation time and enhance the customer's delivery experience, while UPS wants to seek orders other than e -commerce logistics to increase profit margins.

Data from the research company MWPVL International shows that the two companies are reducing cooperation -the number of Amazon parcels processed by UPS in 2022 is 1.3 billion pieces, which is lower than 1.41 billion pieces in 2021.

"We see the absolute number of wraps decrease slightly. Before that, the total number of packages was growing, so the number of Amazon has been increasing. Now the coverage of Amazon is very wide, and they can handle cargo transportation by themselves. "

01ups strategy adjustment to reduce Amazon orders

According to a UPS securities file, the associated revenue of UPS and Amazon decreased from 13.3%in 2020 to 11.3%in 2022. Although affected by the epidemic, the connected income of UPS and Amazon has increased significantly in 2020, but in the next two years, it has declined, because UPS has begun to focus on providing delivery services for healthcare companies and small consignors to get more High profit.

Cowen analysts said when talking about UPS reduction with Amazon's associated revenue: "UPS is reducing the proportion of B2C business with low profits. We are very optimistic about this attempt."

The decline of Amazon's business is not just income. UPS Chief Financial Officer Brian Newman said at a conference call on January 31 that in the fourth quarter, the average daily freight of UPS in the United States decreased by 3.8%year -on -year, about half of which came from Amazon. He added that the decline was consistent with the expectations of the two companies.

Newman said that because Amazon uses its own logistics more, UPS expects that some of its US freight volume will continue to decline this year. However, the increase in freight volume of other customers in UPS can almost offset the impact of Amazon's decline in business. "We will continue to move along the road agreed by both parties, that is, in 2023, we will continue to reduce the affiliated business between UPS and Amazon."

Nate Skiver, the founder of the consulting company LPF Spend Management, said that the reduction of UPS and Amazon's business volume is not necessarily a bad thing for UPS, because this is a preparation decline, not an accident decline. UPS can rely on the high -yield freight orders of small enterprises to make up for the loss of income at a higher unit price package.

02 Amazon actively built a logistics network

When UPS's business focus changes, Amazon's ability has also changed.

Wulfraat said Amazon needs to use UPS because the capacity limits the ability of its own transportation parcel. In addition, Amazon also needs UPS to help it reach the area where the Amazon logistics network is not covered.

"Near Montana Billings, Amazon did not have any logistics centers, sorting centers or distribution stations." Wulfraat said, "If the order comes from the logistics center of Phoenix, then Amazon will send the goods to the customer within two days. The only way is to use UPS. "

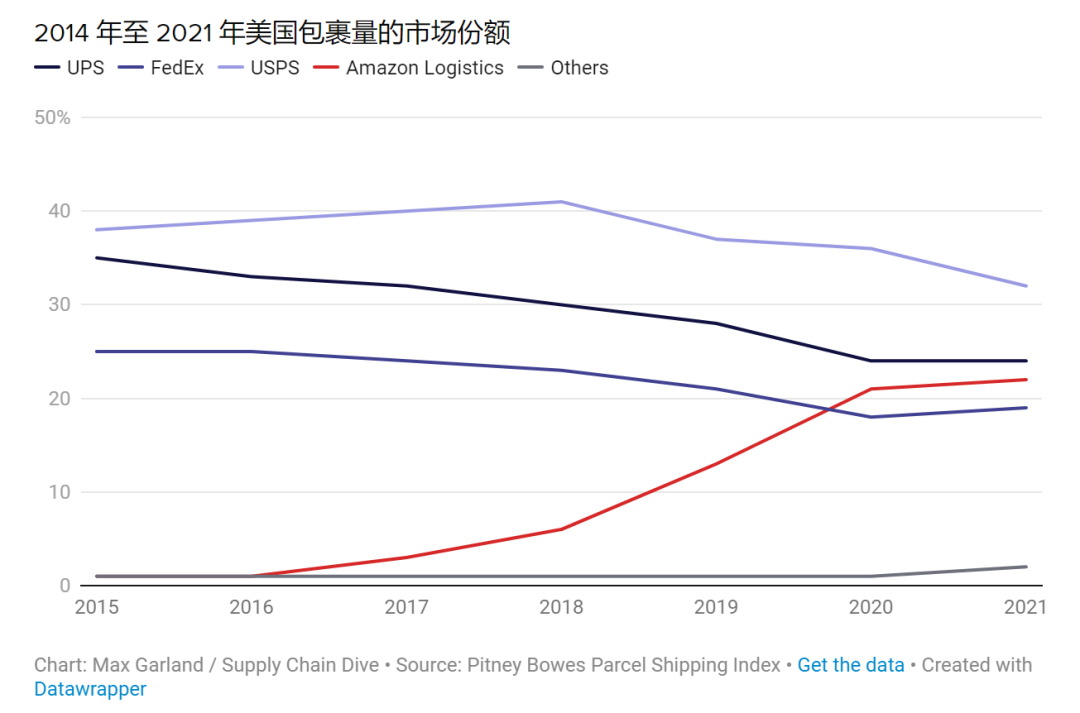

Nevertheless, Amazon is still actively building sorting centers, delivery stations and logistics infrastructure to transport more parcels. According to the Pitney Bowes parcel transport index, Amazon increased to 22%in 2021 and defeated UPS's competitors Federal Express in 2021.

Amazon CEO and CEO Andy Jiaxi said at the financial report on February 2: "In just a few years, we doubled the scale of the logistics center that established 25 years. In a few years, the last mile of transportation network has been built, which is equivalent to UPS. "

03 But Amazon still needs UPS

However, experts say that everything is not absolute, and there are two factors that may change Amazon to reduce plans for UPS.

Amazon has closed several warehouses in recent months and canceled more logistics investment plans in the future because Amazon tried to cut operating costs. Wulfraat said that compared with last year, the reduction of Amazon logistics construction may lead to Amazon's dependence on UPS comparable to last year or even higher.

The decline in parcel prices will also affect Amazon's use of UPS. After years of production capacity restrictions and expenses increase, as demand weakens, the pricing power is slowly moving towards the direction of consignment.

Jasonmurray, co -founder and CEO of the Amazon supply chain and retail service vice president, said that in terms of logistics, Amazon has always placed pricing first. Whether internally or through third parties, the company will pursue the minimum cost of cost. change. "UPS as a alternative logistics dealer" is in line with Amazon's best interests.

Jasonmurray said in Amazon: "If they find that consumption is weak and the market's demand for UPS is declining, they will definitely seize this to reduce their costs."

Previous:A little change? Can Amazon go to the new model?

Next:Amazon suddenly disclosed product sales. Where is the small and medium sellers?