Although e -commerce is growing slowly and facing inflation pressure, the acquisition transaction volume of Amazon sellers has only decreased slightly in 2022. Even if the seller's valuation has declined, the aggregates still maintain a strong demand. forwarder

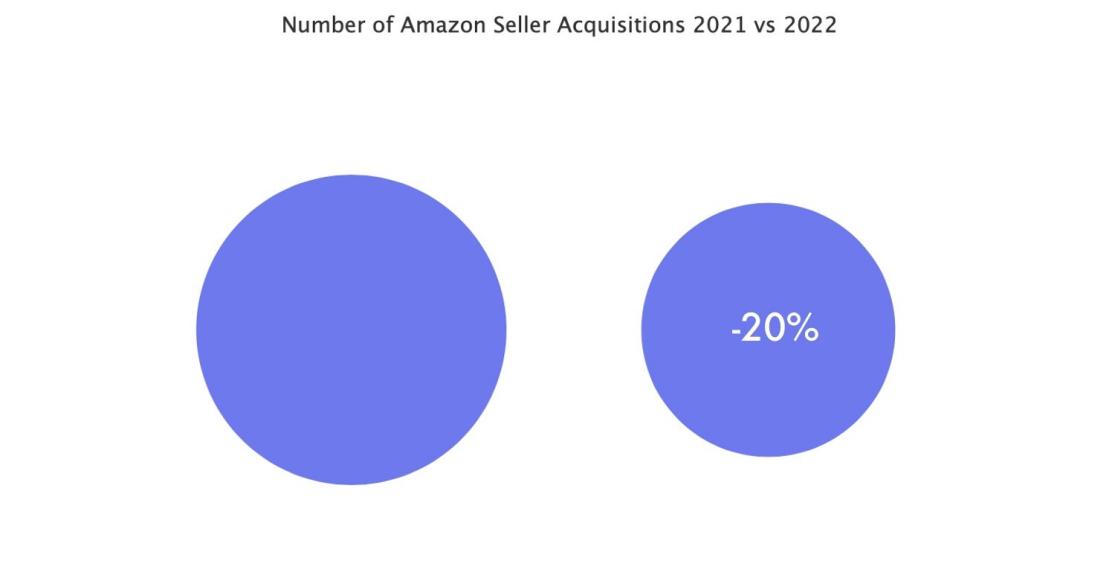

The number of Amazon sellers in 2022 was 10%-20%less than in 2021, and many of the companies acquired are less than 2021.

Amazon companies with a valuation of 6 times and above (excluding inventory) in 2021 are expected to fall to 4-5 times as of 2022. However, sellers who have remained at 4-5 times before the acquisition of the acquisition are relatively unchanged, and they can still be sold at a price of 3.5-4.5 times. At the same time, sellers with a valuation of 2-3 times this year are mainly attracting buyers who are concerned about non-performing assets.

Amazon seller's acquisition price multiples are usually calculated based on the disposable income (SDE) multiples, based on the adjustment of EBDITA or roughly calculated annual net profit. For example, Amazon sellers with a income of $ 1 million and SDE profit of $ 250,000 usually receive a guarantee of more than $ 1 million (4 times the SDE), plus inventory and profitability.

Although some Amazon aggregates have suspended the pace of acquisition (such as ThRASIO and Perch), other aggregate companies are not idle. Instead, they also increased their acquisition channels, and more aggregate buyers poured into the market.

Now, more buyers are aggregating, but they do not call themselves "aggregates", including some strategic decision participants, such as online brands' holding companies, and investing in online native brands (including the Amazon brand) Private equity funds, etc.

The acquisition process is now more lengthy because buyers have become more picky and cautious. In addition, their due diligence methods have become more complicated.

In the past, the funds that Amazon aggregates can enjoy no longer exist. In 2022, the aggregation provider raised only $ 2.7 billion, while the financing scale in 2021 reached US $ 12.3 billion. Most capital (about 75%) is directly used for acquisitions in the form of debt.

Even if some aggregates have deteriorated, the integration of the market has not yet happened. Nevertheless, some aggregates have been actively seeking to acquire by others, and the other part is actively looking for "peers" that can be acquired. Market integration between aggregates will bring a scale economy, and can allow the successful acquisition to obtain better financing conditions. logistics

It is unclear whether the aggregate model is really feasible, but it can be certain that the acquisition continues.

Michal Baumwald Oron, CEO of Fortune, said: "The number of acquisitions as of 2023 will be kept at a level in 2022. The acquisition valuation multiple has tended to normalize and will remain unchanged until the macroeconomic indicators will improve."

Previous:Why is Amazon product review and rating important for growth?

Next:TIKTOK SHOP peak season hot sales trend: grasping warm winter and gift attributes