Compared with self-delivery sellers, the impact of Brexit on Amazon FBA sellers will not be great, but there will inevitably be many uncertain factors. Therefore, FBA sellers should also prepare in advance for the "chaotic situation" that is likely to occur after the transition period.

According to the latest official announcement issued by Amazon, after the Brexit buffer period ends, FBA goods using the European Distribution Network (EFN) will not be able to be delivered through the border between the UK and the EU. In addition, the FBA European Integration Service (Pan-EU) inventory transfer between the United Kingdom and the European Union will stop (but the FBA European Integration Service will continue to ship inventory in the EU region to facilitate sellers in Germany, France, Italy and Spanish warehouse for sales).

So for Amazon, Brexit will not have a substantial impact on FBA. But Amazon sellers need to find a suitable solution to solve the cross-border transportation between EU countries and the UK.

Will Brexit affect FBA seller inventory?

Brexit will have an impact on sellers’ cross-border listings. Amazon sellers’ inventory is likely to accumulate in Amazon warehouses for some time. Amazon has set the following time limits to minimize sellers’ plight:

On November 14th, inventory clearance orders for cross-border inventory will stop, which means that from this day the inventory clearance orders from the UK logistics center to the EU and from the EU logistics center to the UK, but all clearance orders created before this date will be Continue processing until December 31, 2020.

The transfer of FBA stocks between the UK and the EU will stop on December 18.

Cross-border distribution via EFN and pan-European FBA will start and end on December 21st.

Cross-border sales activities through EFN and pan-European FBA will come to an end on December 28, which is the last day when consumers in EU countries can purchase British FC products.

James Wilson suggested that products sold in early 2021 should arrive at warehouses in the UK and the EU before December 18, so as to effectively avoid delays in delivery.

Sellers all know that if the goods remain in the FBA warehouse for a long time, Amazon will charge the sellers additional storage fees. Sellers should arrange the goods on the shelves reasonably and do not let the goods remain in the European Union countries or the British Amazon warehouse.

The best way is to ship the goods to the overseas warehouse before November 14 and sell the goods before December 28 by using the local delivery method to send the goods.

After the Brexit buffer period has passed:

From January 1, 2021, FBA sellers must use British FC goods to maintain domestic orders in the UK. If sellers sell in EU countries through Amazon, they have many options.

However, these do not apply to small and lightweight products. Strictly speaking, this type of inventory only applies to the United Kingdom.

However, the seller can still maintain the operational stability of the store in the following ways:

1. Promptly send inventory to FCs in EU countries and enable EFN.

If buying for local consumers, the seller only needs to pay the local FBA performance fee; if buying for consumers in other EU member states, the seller needs to pay a higher EFN fee.

2. Join the FBA export plan to enable FBA to enter the European Union. In this way, the seller's products will be shipped to customers from the UK and 27 EU countries.

3. Send inventory in batches to EU FC through PAN-EU, and Amazon will decide which FC the final product will flow to.

Therefore, sellers only need to pay for the expenses incurred in the UK and not have to bear the impact of consumer returns.

After the transition period, the seller may consider PAN-EU

Pan-EU is a very effective method to increase the sales of sellers in the EU region, because it can not only ensure that the seller’s inventory is close to the consumer’s inventory, but also that consumers can enjoy fast Distribution services to promote store sales.

For orders in different countries/regions, the seller only needs to pay the freight to the country/region where the transaction is completed according to the FBA shipping fee standard, which saves the seller a certain amount of freight.

Under normal circumstances, the use of PAN-EU generally needs to include 7 VAT numbers in Germany, France, Italy, Spain, the Netherlands, Poland, and the Czech Republic. However, the new PAN-EU VAT service is applicable to those who wish to send inventory on behalf of Amazon but do not wish to Sellers who declare, pay and recover VAT in the above 7 countries only need to meet the following requirements:

You can use MCI to carry out sales activities in at least two countries, obtain and upload the VAT codes of these countries, in these countries FC has product inventory, and there are 5 Listings (Germany, Europe, France, Italy and English) on the Amazon website.

Effects of border control after Brexit

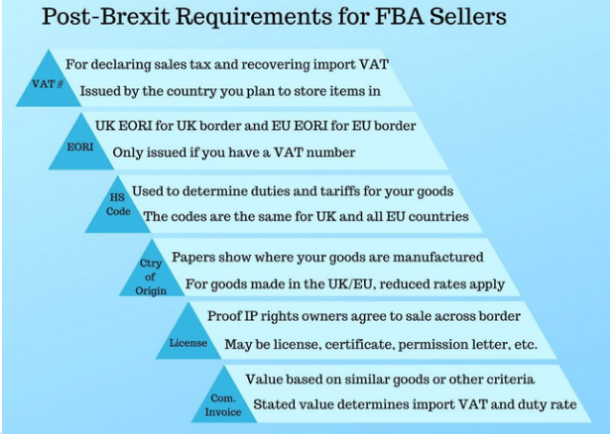

According to Announcement No. 301 on September 23, 2020, if FBA sellers fail to properly declare VAT, EORI, HS code, product origin, relevant licenses and money orders before the goods arrive at the Amazon fulfillment center, they will be fined 250 by British Customs. GBP.

For FBA sellers, pay attention to:

1. Applying for VAT is the first, most important, and time-consuming step to comply with regulations.

2. PAN-EU can be used even if the seller has only registered an EU VAT number.

3. The seller requests to obtain the EORI code from one British customs, but obtains the EORI code from one EU country customs.

4. Customs brokers often charge a customs clearance fee of 130 to 180 pounds for each piece of goods and each cross-border transshipment, and some charge a certain percentage of the total value of the goods.

5. The customs broker may also charge the initial fee and charge a deposit for unpaid duties.

6. Amazon SPN provides sellers with a variety of customs brokers, agents, freight forwarders and transportation companies.

7. The Amazon VAT service is free for the first year, and since then, the annual charge for each country is about 400 Euros.

8. The UK/EU trade agreement may reduce tariffs on products manufactured in the UK/EU, but it cannot benefit from imports from third parties such as China.

9. For those products that do not require pre-preparation work, the manufacturer will ship part of the stock directly to the UK and part of the stock to the European Union. This is the most ideal, because after doing so, the seller only needs to pay tax once for each batch.

10. From 2021, British brand owners must register their trademarks in the United Kingdom and the European Union before trademark registration.

11. From 2021, brand owners listed on Amazon in the UK can continue to report possible infringements on Amazon.co.uk, but they must register the UK IPO trademark in the Brand Registry.

12. The new regulations will take effect on January 1, 2021. Sellers can log on to the official website of the British Customs Administration to inquire specific information about the harmonized system code and VAT, and the definition of the value of the declaration product.

Previous:How do Amazon sellers dig out product keywords, several common ways, and favorites!

Next:Small parcel express cross-border service with cooperating carrier on Amazon UK station