In the state of the economic environment in 2022, the revenue of the beauty giant Ultra Beauty and the LVMH of Sephora's parent company still hit a new high. However, these two vertical fields have not made Amazon's "posture".

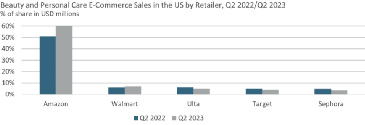

Amazon's 11 categories of cosmetic and personal care in the United States are in obvious online leading positions, and they are still expanding market share. According to the recent e-commerce data released by Euromonitor International, compared with 2022, in the second quarter of 2023, except for hair removal products, Amazon has a considerable market share in all cosmetic categories.

In the American makeup e -commerce market, Amazon's influence between Amazon and Wal -Mart cannot be ignored, but compared with Amazon's 60%market share, Wal -Mart seems to be dwarfed.

01 · Amazon's road to win

Amazon provides a daily low -cost, extensive range of product scope and service in place, and has gone forward in the field of beauty and many other fields. On the other hand, the positioning of beauty platforms such as Sephora is higher and the price is higher. Defeat many beautiful makeup vertical platforms.

In addition, according to e -commerce data from the EUROMOOR International, the online market share of Ultra Beauty and Sephora in 2022 has declined, and sales in the second quarter of 2023 were almost the same as the same period in 2022. In comparison, Amazon's sales exceeded $ 1 billion, thus gaining the advantage of occupying the online market.

At the same time, the peak season promotion is also one of the reasons for Amazon's success. Amazon received one -third of sales in the fourth quarter in 2022, while Ultra Beauty's fourth -quarter online sales accounted for 27%of the total annual total.

In the fourth quarter, large -scale promotional activities such as the peak season and PRIME Day are undoubtedly the magic weapon of Amazon.

02 · Promotional activity see the true chapter

Prime Day and Prime Early Access activities are the annual promotion of the Amazon platform. During this period, thousands of special products will be launched, including many beauty products.

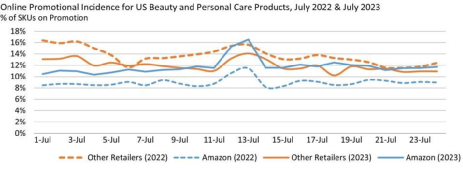

Euromonitor's consumer survey results show that 60%of consumers said that participating in retail platforms are discounted, followed by free delivery and new products. At the same time, Amazon's beauty protection product promotion ratio reached a peak level of 17% during the PRIME Day period on July 13, higher than the average level of 11% outside the promotion period. Although the discount rate of other beauty platforms has also changed, it is far from Amazon's benefits to consumers. FBA shipping

Well, Amazon's Prime Day discounts in 2023 are greater than in 2022.

In the first half of 2023, Amazon's beauty protection promotional products were less than other retailers, and only 11%of SKUs were promoted. In contrast, Ultra Beauty's promotion is 11%.

As Amazon's perennial competitors, Wal -Mart's beauty protection rate is 18%.

The promotion entry points of various platforms are also different: Amazon vigorously promotes special products for infants and young children, followed by deodorant and perfume; Wal -Mart is perfume, makeup and hair care products.

Previous:Amazon's old link traffic declines? Try this optimization method

Next:These methods can significantly improve the Amazon conversion rate