Druori pointed out in its latest market analysis and forecast that the shipping company has lost its control of the market, does not actively manage capacity, but does not change its nature, and returns to the old road of "price war".

A few months ago, Druori also believed that the shipping company would take necessary measures to reduce the capacity before the market was completely out of control; and it was believed that the marketing industry had undergone structural changes. The company's (fighting price war) old habit, but in the latest forecast, Druori acknowledged that judgment was wrong.

Now, Druori believes that only under severe losses, the ship company will actively change. Earlier, when the marketing market began to show signs of weakness, the shipping company obeyed the deep -rooted instincts, and ensured short -term orders through the price reduction and ensuring the amount of goods instead of controlling capacity. Afterwards, at that time, the shipping company needed to take the initiative to take measures, so that it was not now exposed to the external market forces.

The shipping company did not do anything. They launched a large number of air navigation, but did not take effect. The current freight rate continued to fall, and the five-year average price of the five-year price between 2015-19 was quickly close. Nowadays, after the prosperity of the market for the prosperity of the market, 2021-22's record orders (about 6.7 million TEU capacity) are very redundant.

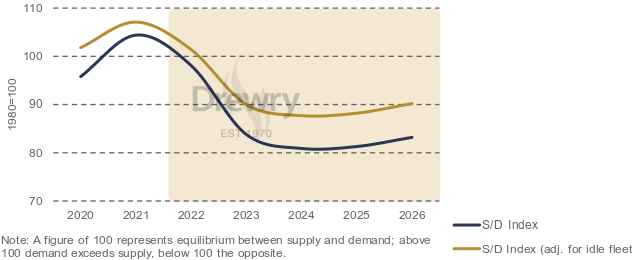

The global supply and demand curve diagram of Deluli, the curve value is higher than 100 indicates that the supply is required, and the supply is too required to be too required.

De Lu said that reducing capacity will make the shipping power growth rate of 2023, which is about 1.9%, but the supply chain blockage will release a lot of capacity, so that the effective capacity is expected to increase by about 19%. Essence Therefore, the current offer of shipping contracts is only a little compared to a year ago. According to the observation of Deluli, the proportion of idle fleets is only slightly higher than three months ago, and the shipping of the ship has just started. The current reduction of capacity reduction measures did not take effect. De Luli tracked the profit and loss point of the three main routes through the following charts. freight

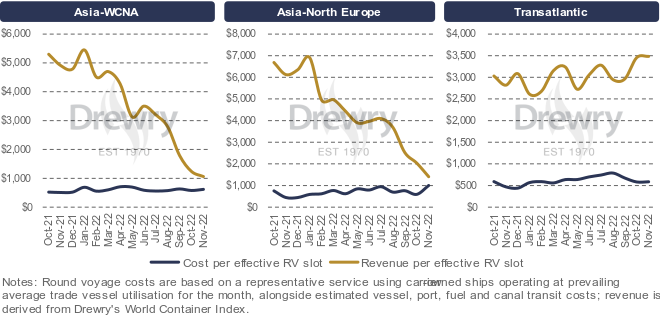

The blue line represents the cost of the route, the yellow line represents the income of the route, and the unit is Teu/USD. From left to right, it is Asia-Western, Asia to Northern Europe, and cross-Atlantic routes.

The chart shows that the profitability of the Asia-West and Asia-Nordic routes is rapidly falling, but it is still favorable. Therefore, the ship company lacks the motivation of greatly reduced capacity. However Breaking the balance point, on the other hand, the profit of cross -Atlantic routes is still considerable.

This chart is like a doomsday clock, counting the loss of the shipping company, Delu Li believes that the profit and loss line of Asia-West and Asia-Nordic Line will meet, which will promote the shipping company to take action. They want to see if the window period (from January 22) before the Spring Festival will have a peak of order, and at the same time, some capacity can be transferred to the cross -Gateon route to make money.

Therefore, De Lu believes that, given that the amount of goods has decreased at an amazing speed and the shipping rate is close to the profit and loss balance, the shipping company will make significant capacity adjustments in 2023 to prevent the freight from falling to the level of profit and loss, instead of passing effective capacity management. Make the profit margin higher than the historical average.

Deluli estimates that in 2023, the comprehensive operating profit of the transportation industry will decline to $ 15 billion, only 5%($ 290 billion) in 2022. Other consulting agencies also express their views. Linerlytica said At the beginning of the year, the market may be caught off guard, and there may be losses this year; John McCown (producer of the quarterly trains company profit report) is relatively optimistic. Factors; Peter Sand, the chief analyst of the freight price platform Xeneta, believes that what needs to be concerned about is idle fleet. Xeneta's estimated 25%of the container ship orders will be postponed, and no more than 10%of orders will be canceled (mainly due to executable orders, while, while the order can be executed, and the order can be executed. Non -cost directly cancel orders). Peter Sand believes that more shipping companies in the Changxie will remain profitable. Companies struggling in the spot market are already losing money, and they will continue to lose in the future.

HSBC believes that inflation will continue the demand in 2023, and now there will be a lot of transportation power into the market for the next two years, which may trigger a new round of price war; The amount may increase, and the scrap capacity at the end of this year will reach about 270,000 TEU, and will increase a greater increase in the following years. Xeneta is expected to waste 400,000 TEU capacity, which is still gap compared to the 2016 record (696,000 TEU). MSI also said that Tianping has obviously tilted to the owner. Unless the cargo owner gets the rate before the epidemic, it will not make a large -scale contract commitment, and the ship company and the owner will not be able to pay for it.

The decline in the amount of goods is obvious to all, and there are divergent opinions of various consulting agencies. The differences that the differences are that the shipping company will respond to the dilemma, or whether the ship company can still be profitable. The mainstream views once believed that the alliance could get rid of the vicious cycle of the cycle and the price war. However, in a historically stable industry, the greater the participant, the more difficult to get rid of the industry's inertia.

Previous:horrible! The main goods conceal the check -in! 2.3 billion yuan of cargo aircraft burned and scrapp

Next:The US imports continue to plummet, and the decline will continue in this spring