1. MSC surpasses Masisky to become the world's largest collecting company (company dynamics)

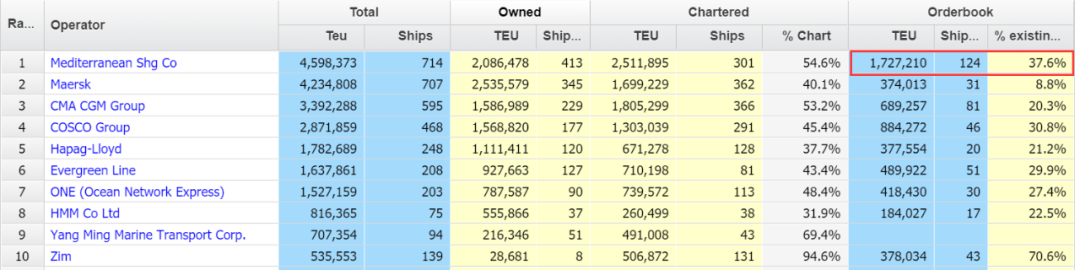

Since August 2020, the Mediterranean Shipping MSC has launched a large -scale second -hand ship acquisition plan, which has made the company finally calculate the scale of the seafire capacity of the container ships controlled on January 5, 2022. Container Shipping Company.

However, MSC did not stop because of this. After the shipping power surpassed Maski at sea, MSC also continued to acquire second -hand ships in the market.

According to the latest data provided by AlphaLiner for Nobella Maritime Network, from August 2020 to the present, the company has acquired 263 second -hand container ships on the market, with a total capacity of more than 1 million TEUs. It even exceeds the total capacity of the container fleet controlled by the eighth largest container shipping company in the world's eighth largest container shipping company.

In terms of new shipbuilding, MSC also has a huge amount of orders. The company currently holds 124 new shipping orders for a total capacity of about 1.75 million. The 10 -year ship sharing agreement between MSC and Maski will expire in 2024. Some analysts speculate that MSC, which has a huge fleet, may jump out of the league independently after the agreement is over.

2. The "Felicity ACE" wheel burns the sinking accident in the Atlantic Ocean (new security issues under the new market)

On February 16, local time, a rolling ship with Porsche and Volkswagen named Felicity Ace issued a signal of a risk signal about 90 nautical miles southwest of Atlantic Island. The Acel Islands sinking. This voyage is full of cars of Porsche and other brands of other Volkswagen. After estimated, the total loss is about 500 million US dollars.

This is the fourth large -scale rolling boat fire involving electric vehicles since 2019. The ship owner is the Japanese merchant ship OSK LINES (MOL). After the accident, MOL said that he would no longer carry second -hand electric vehicles. The shipping company faces some difficulties in checking electric vehicles. For traditional gasoline and diesel cars, before loading the ship, the relevant personnel will conduct a safety inspection to ensure that they can drive under their own motivation without leakage. But second -hand electric vehicles are difficult to perform such procedures.

With the prosperity of the electric car maritime transportation market, the safety issues during the maritime transportation process of electric vehicles have also begun to appear. Although electric vehicles are not the only reasons for causing a rolling boat to fire, due to the physical characteristics of electric vehicles, it has super in terms of burning assistance. Strong ability. Studies have shown that after the lithium ion battery of electric vehicles is on fire, the temperature can reach 2,700 degrees Celsius. Once the fire of electric vehicles transported by the ship is very difficult to deal with the fire accident, and the loss will be large.

3. Russia and Ukraine Reinstances the map of global energy shipping (geopolitics and shipping market)

In the order of time, the Russian -Ukraine conflict ranks third, but there is no doubt that the impact of the Russian conflict on the shipping industry this year is undoubtedly the huge.

At the beginning of the Russian and Ukraine conflict, three ships encountered various explosions, and then two cargo ships were attacked by artillery shells, and several seafarers suffered to varying degrees of damage. On February 24, the local Ukrainian local authorities decided to close the entrance of OdesSa and Chernomorsk. In this regard, Guy Platten, Secretary -General of ICS, once called on: "The safety of crew is our absolute priority. We call on all parties to ensure that the crew will not be an attached damage to any action that the government or others may take. At the forefront of maintaining smooth trade, we hope that all parties will continue to provide convenience for the free passage of goods and these key workers at this time. "

With the continuous upgrading of the Russian conflict, the sanctions of Britain and the United States and the European Union also followed. On March 8, local time, US President Biden gave a speech at the White House, announcing the ban on the import of oil and gas energy from the import of Russia. The EU has introduced a series of sanctions to pressure Russia. As of now, the EU has passed the ninth round of sanctions against Russia. Among them, there is a major blow to Russia's oil export trade: it is forbidden to provide EU insurance operators to provide services for maritime transportation for Russian oil transportation to third countries.

However, there are two sides of everything. After the Russian and Ukraine conflict, European and American sanctions on Russian oil and petroleum products have also created a fiery tanker market.

At the same time, the United States and the European Union against Iran, Venezuela, and sanctions against Russia are bringing increasing security risks to the shipping industry. In recent months, all parties related to Russia have been spending crazy consumption and buying a lot Old oil tankers in order to prepare for the new sanctions beginning earlier this month. These old vessels were forced to engage in more dangerous transportation operations without providing the best ship management, board -grade and insurance. Industry insiders warned that the continuous expansion of the Dark Oil Roules Fleet has not only threatened the reputation of global shipping, but also caused the safety of seafarers' lives and the risks of the environment.

4. Singapore fuel pollution accident, 200 ships are affected (shipping safety issues)

In March of this year, the data provided by the fuel test company VPS (Veritas Petroleum Services) showed that more and more ships were equipped with contaminated ship fuel in Singapore and encountered a ship out of power. As of April 3, the number of ships that encountered problems in Singapore had reached 60, and the total contaminated fuel had been confirmed to 140,170 tons, and the total market value reached 120 million US dollars.

Subsequent investigations revealed that these issues were mainly from 12 bargains, from two suppliers -Jianeng and PetroChina. The batch of problems of PetroChina actually came from Jianeng. What's more terrible is that it is difficult to find such routine detection methods such pollutants. These pollutants can cause more clay in fuel pipelines and fuel pumps, and eventually stop the engine.

Singapore Maritime and Port Authority (MPA) provided two phased Singapore port issues on April 13, 2022 and May 5, 2022, and completed a survey of ship fuel pollution on August 3. The survey found that Jianeng supplied fuels that were affected by 24 vessels from March 22 to April 1st, supplying fuels contaminated by high concentrations of COC. At least 3 vessels reported their fuel for fuel fuel. There are problems with pumps and engines, which seriously violate the terms of its refueling permit (fuel supplier) (to ensure that the fuel provided is not polluted).

5. Frequent strikes of overseas ports, affecting the normal operation of the supply chain (logistics supply chain)

Due to highly intensive inflation disputes, large -scale and long -term strikes have recently held large -scale and long -term strikes for port workers in many places in Europe to improve salary and working conditions.

In mid -July, thousands of port workers in Germany held a 48 -hour strike, which severely disrupted the operation of multiple container hubs including Hamburg Port. The reason for the strike is that both workers cannot reach an agreement on how to help Hong Kong workers cope with the rising cost of living.

From August 21st to 29th, due to the breakdown with the port group on the salary increase, the workers of FelixStowe, the largest container in the United Kingdom, strike. Port Felixto is the largest and busiest container port in the UK. The port has dealt with about 48%of the UK's container trade. About 2,550 people worked in the port. The profit of the port company in 2021 increased by 75%. The Unite Union rejected the 8%salary provided by the port owner C.K.Hutchison Holding. Unite Secretary -General Sharon Graham said that C.k.hutchison Holding Putting shareholders 'profits on workers' benefits, they can pay more decent salary increases to port workers.

The number of workers in this strike included a crane driver, machine operator and loading and unloading workers in the loading and unloading ships reached 1,900. According to the MDS Transmodal's trade data analysis, the total value of the container cargo affected by the 8 -day strike is estimated to be $ 4.7 billion

In addition to the above -mentioned strikes, there have been several strikes and threat strikes in Europe and other ports in Europe and other ports this year.

6. Xu Bo, a Chinese deputy deputy, won the world's only "Special Brave Award at Sea" this year (Chinese seafarers)

This year, the IMO of the International Maritime Organization awarded to the Chinese Deputy Deputy Deputy Deputy Deputy, the world's only maritime award at the world.

On the morning of December 12, 2021, a freighter named Tianfeng 369 encountered severe weather, entering the water at 30 northeast northeast of Zhiwan Bay and began to sink. At this time, the oil tanker "Jianqiao 502", which is going to Dongguan Port, immediately changed its flight to assist in dangerous ships. After an hour and a half of the search, Xu Bo found a floating but water life raft with two survivors on it. However, because the two survivors were too weak at the time, they could not be tied to themselves firmly. Xu Bo Da jumped into the cold sea water without hesitation, fighting with huge waves and strong streams, and struggling to swim towards the raft. After several attempts, it was finally enough for the life raft and tied the rope to the survivor. Then the two survivors were successfully transferred to the deck with the help of other crew members. After returning to the ship, despite his fatigue and cold, Deputy Xu Boda immediately rescued the two survivors.

The International Maritime Organization (IMO) said on the website: "In view of the spirit of the Chinese deputy deputy Ying Ying's fearless salvation, it was awarded the 2022 IMO 'Special Brave Award at the Maritime" to recognize him when he rescued the two crew members showing two crew members showing two crew members showing two crew members showing two crew members. The bravery, determination and endurance. "It is understood that the IMO's" Special Brave at the Maritime "is divided into three -class: the first class is the special bravery medal at sea, the second class is a commendation certificate, and the third class is the commendation letter. In 2022, the award received a total of 41 nominations from 17 member states and two non -governmental organizations, and finally only received the "Sea Special Brave Award" medal.

7. Norwegian Ship King John Fredriksen and the Saverys family on the battle of Euronav's control (company dynamics)

On April 7, the Norwegian Ship King John Fredriksen's oil tanker FRONTLINE and the Belgian independent oil shipowner Euronav jointly announced that the board of directors of the two companies had reached an agreement on the proposal reached by the merger of stock exchange. At that time, the news triggered the opposition from the Saverys family. The family tried to prevent its competitors from acquiring Euronav and said: "We are the largest shareholders of Euronav. Not taken abroad. "

On May 23, the Norwegian Ship King Frederiksen won the first battle with the Saverys family on the control of Euronav's control. At the annual shareholders' meeting of Euronav, more than two -thirds of shareholders voted against the three representatives of the Compagnie Maritime Belge (CMB) of the Saverys family into the board of directors.

On June 13, the Norwegian ship king John Fredriksen once again increased its holdings of Euronav, which was close to the company's equity of the Saverys family, and the two companies were competing for the control of the Belgian oil tanker.

On July 11, the Norwegian Ship King John Fredriksen's oil talker company Frontline and Belgian oil ship Euronav announced the signing of the final agreement and agreed to merge in the form of full stock transactions. John Fredriksen had a closer step away from his oil tanker. The details of the merger show that the Euronav brand will disappear. The merged group will be named Frontline. The place of registration and headquarters will be located in Cyprus. In the past few decades, Fredriksen has established most of his shipping empires on this island.

From August to December, the Compagnie Maritime Belge (CMB) controlled by the Saverys family was acquired through a series of acquisitions, and the shareholding of Euronav has exceeded 25%of the oil ship Ship Lord Euronav. It further expressed its merger of all shares of the two companies of Frontline and Euronav. Opposition.

At present, the two sides are still tearing.

8. The golden period of the market for the market has passed, but the annual profit is still a record (collecting market)

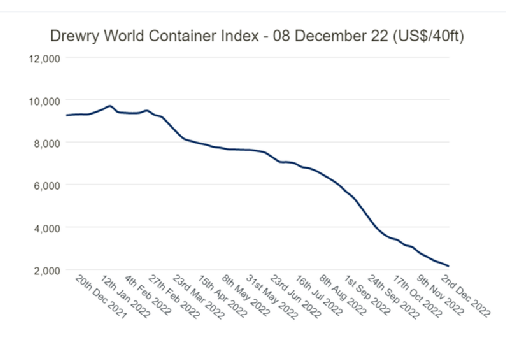

Earlier, the Baltic Shipping Index (FBX), which created 11129 Polo Exchange (FBX), has been maintained at more than 9,000 points from the end of July 2021 to the beginning of May this year, but it has fallen to 4731 points at the end of August. The demand for consumer goods in the Western world led by the United States has increased, which has led to severe congestion in the global port container vessels. In the past two years, collecting companies have enjoyed the huge benefits brought by high freight. The elimination and high inflation have weakened consumer demand, and the era of ultra -high freight rates has quietly ended.

On December 8th, the WCI report of the World Container freight index issued by the shipping consulting agency Drewry showed that the container's current freight rate fell in the 41st weeks, which fell 77%compared Already below the epidemic.

From the perspective of subdivided routes, the freight rates from Asia to the Nordic route have encountered the worst decline. Analysts of Danish Shipping Consultation Sea-Intelligence said that the starting prices of cross-Pacific Ocean to the West Coast and Asia-Europe Trade routes are lower than the epidemic. Before the level. Newly joined players on the Eastern and Western transportation routes are being severely hit. Only after the establishment of the British shipping company Allseas Global Project Logisitcs, it applied for bankruptcy in October after failing to fulfill its lease commitment to deploy six ships. In addition to AllSEAS, Culines, China Union Shipping, has recently terminated the lease of 12 Panama -type container ships currently deployed on the United States and European routes in advance (shipowner is Antong Holdings Co., Ltd.). Lines jointly operates every two weeks of Asia -Europe Express routes.

The veteran of the container shipping market, Claus-Peter OFFEN, a well-known German container shipowner, said that for container ships, the current situation looks similar to 2009, and the worst moment of container ships is coming.

Although the financial report data for the whole year needs to be further disclosed, it is on the board that the performance of most large collective companies this year will be better than last year and set a record.

9. Oil market outbreak, welcoming the golden period of freight rate (oil tanker market)

In the middle of this year, the downturn's oil tanker market continued to rise. With the continued rise of oil rings, the transaction of the second -hand market market was continuously reached. , Second -hand oil wheels are now sought -after goods. "

During last month, the freight price of some oil tankers could even be described as "out of control". Because the shipowner profitable by transporting Russia's crude oil through the beginning of the European Union's ban on Russia, the tonnage can be used. The week rose 56%. The refined oil ship shipping market is also hot, but Robert Bugbee, President of the US -listed refined oil tanker company, said that the highest peak of the refined oil rotation market is far away, and the party has not yet begun.

Danish Shipping Corporation Norden has raised its annual performance expectations 6 times a year, proving that the speed of making money in the refined oil tanker market this year has exceeded the imagination of shipowners.

Looking forward to the future, BIMCO stated that in terms of supply, the supply of crude oil and refined oil tankers will be low; in terms of demand, the increase in oil production and consumption consumption will increase, coupled with the increase in oil -producing countries' oil refining capacity, it is expected that the demand in the crude oil tanker market in 2023 is expected The amount increased by 0.5%-1.5%, and the demand in the refined oil rotation market increased by 2-3%. The European Union will further impose sanctions on Russia's oil and oil by-by-site products, which will increase the average range of the two markets by 2-3%in 2023 and increase the overall demand. Overall, BIMCO is expected to improve crude oil and refined oil trade in 2023, and will continue to improve slightly in 2024.

Shipbuilding Lorentzen & CO said that due to the uncertainty of the G7 countries' upper limit on Russian oil prices to the oil tanker market, the demand for crude oil and refined oil tankers may occur in 2023.

In fact, this year's liquefied natural gas shipping market and the rolling ship shipping market can also be described as hot.

10. The EU incorporates shipping into the carbon transaction emissions plan (green shipping)

On November 30, after several months of negotiations, the European Union finally reached a preliminary agreement to incorporate the shipping industry into the carbon emissions trading system. According to the agreement, all 5,000 tons and above ships sailing between the Port EU countries must pay for 100%of the emissions; 50%of the payment emissions are required. The cost of payment increased with time, from 40%in 2024, to 70%in 2025, and 100%by 2026. But at the same time, these numbers still need to be confirmed by member states in the next round of negotiations.

It is worth noting that the preliminary agreement finalized this time is more widely discharged from the previous proposal, including not only carbon dioxide, but also methane and nitrogen oxides; At the beginning, the European Union's monitoring, reporting and quantitative systems will cover ordinary cargo ships and offshore ships with a total of 400 to 5,000 tons. By the end of 2026, the European Commission will study whether these ships will also be included in the discharge transaction plan. From 2027, more than 5,000 tons of offshore ships will have to purchase emission rights; the implementation time is delayed from 2023 to 2024. It has been implemented in stages of shipping emissions of European routes and reached comprehensive coverage in 2026.

Previous:At the beginning, large container ships and dry cargo ships were sent to the shipping factory!

Next:Shanghai Port container throughput ranks first in the world for 13 consecutive years;