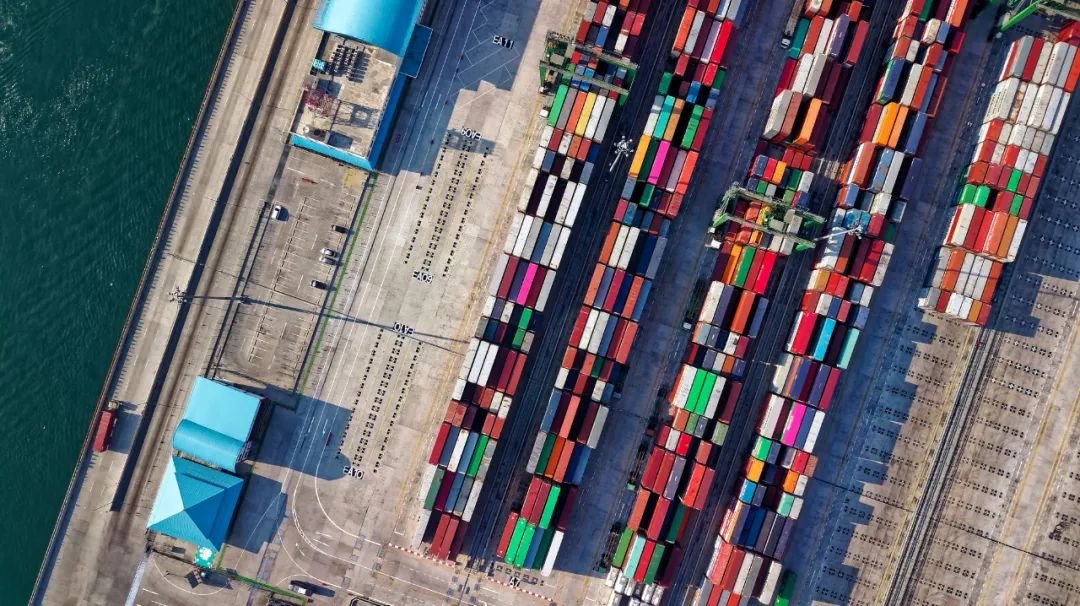

It is reported that Dafei Sea Transport Group announced yesterday that it had signed a binding agreement to acquire the two container terminals of New York-New Jersey Port GCT Bayonne and GCT New York. These two docks are currently held by the Global Container Terminal (GCT).

New York-New Jersey Port is a key entrance to provide services to the supply chain area of the United States. It is also the largest port in East. The investment is the time when the port has become the most active container port in the United States. Da Fei said that the current annual throughput of the two docks is 2 million TEU, which has the potential to further expand, and the capacity can be nearly doubled.

The GCT Bayonne Wharf has the highest level of automation and the fastest truck in the port, the most connected to offshore transport channel, and the ability to provide services for container ships with a capacity of 18,000teu.

GCT New York Wharf benefited from the efficient labor force of New York-New Jersey Port, and connected densely connecting densely connected to the hinterland of New York by direct truck transportation and multi-type transportation. At the same time, it was the only pier with a dock centralized inspection station and 66,400 square feet refrigerated warehouse. facility.

Dafei CEO Rodolphe Saadé said that the acquisition strengthened the service and supply chain efficiency provided by Dafei for American customers, and further consolidated Dafei's position in the world's fastest growing major market in the United States, and will be will and will be will be. Help it continue to develop.

Dafei said that its plan to further develop its shipping line in New York, which will provide them with the capacity required for the future. The group will greatly accelerate the investment and development of these two docks, with the goal of increasing its comprehensive capacity by 80%in the next few years.

The acquisition will strengthen Dafei's position as a global port operator. At present, Dafei's joint venture through CMA Terminals and its Terminal Link has invested in 52 port terminals in 28 countries around the world.

In November last year, the company spent $ 2.3 billion to acquire 90%of the Los Angeles Port FMS Terminal. Combined with the 10%of the already held, Dafei became the only owner of the dock. (For details, check: Dafei acquisition of one of the largest port pier in the United States at 2.3 billion US dollars, holding 100%of the shares)

In addition, Dafei also has 4 dock assets in the United States: PMS (10%) in Los Angeles, Dutch Harbor (100%) in Alaska, Bayport (26%) of Houston (26%), and SFCT (26%) of Miami.

The completion of this transaction needs to be approved by the competent regulatory agency. After the acquisition is completed, these two docks will operate as a multi -user terminal under the leadership of the existing management team.

In addition, Bloomberg reported in October this year that GCT is looking for buyers for its dock business in New York-New Jersey Port, and the value of assets may be about $ 3 billion. Investment Co., Ltd. (TIL), Carrix and Herbertot.

Previous:In November, the heavy box throughput of foreign trade decreased by 9.7% year -on -year

Next:Do you know the container installation cabinet?