The rapid turn of the freight seems to be quickly bringing the market to the chain reaction. Different from the previous blunt knife cutting meat, although the third -quarter forecast released by the liner company is still earned, it is not as good as expected. The enthusiastic market is cooling. Shining money bags to deal with challenges are becoming two options.

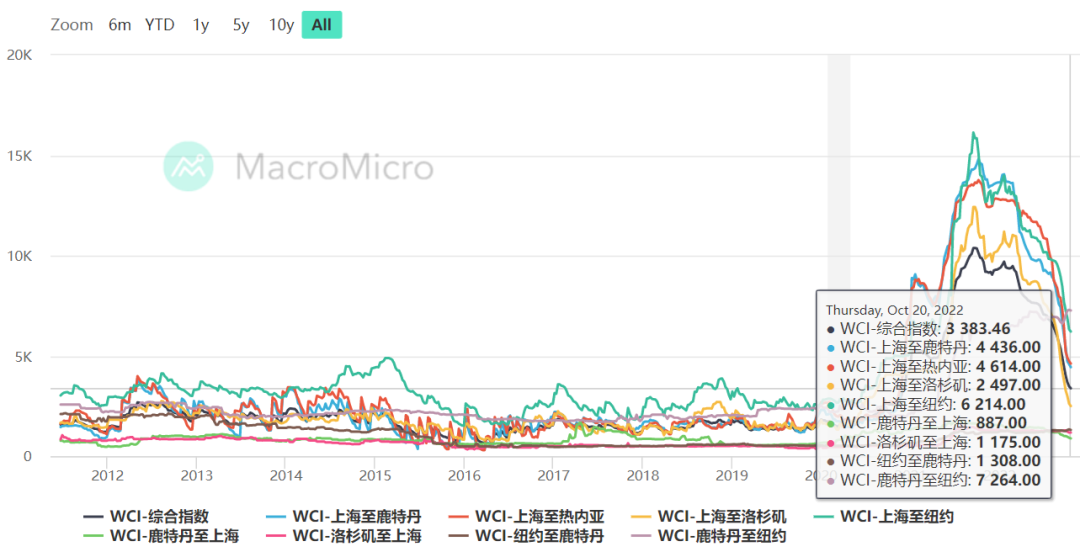

Drewry World Container Freight Index (WCI)

According to the latest show of the shipping freight index (WCI), on October 20th, the spot price from Shanghai to Los Angeles was $ 2,497/Feu, a 74.3%fell by 74.3%compared to the $ 10,898/Feu in 2021. On October 21, the FreightOS Baltic container freight index (FBX) showed that China-Western Coastal shipping price was $ 2546/Feu, a 85%from the beginning of the year.

Not only that, in the next 5 weeks (43-47 weeks), ship companies are carried out a lot of blank voyage. On the main routes such as the cross -Pacific, Asia to Northern Europe, and the Mediterranean, 82 of the 721 scheduled voyages were canceled and the cancellation rate was 11%. 56%of the blank voyages occurred on the cross -Pacific eastward route, 23%occurred in Asia to Europe and the Mediterranean routes, and 21%occurred on the cross -Great Westward trade route. During this period, the three major alliance canceled a total of 63 sailing, of which the Alliance canceled 29 times, and the Ocean Union and the 2M Alliance were canceled 18 and 16 respectively.

As the Ministry of Transport has not announced the data of cargo throughput in September of the major domestic ports in China, as the ends of the East and West routes, import data from West and East Port may be used as a weakness of the transdiflower route. The busiest port in the United States completed the total amount of container throughput of 709,900 TEUs in September, a year -on -year decrease of 21.4%; the amount of imported containers was 345,600 TEUs, a year -on -year decrease of 27%, which also set the lowest import data since 2009. The Port of Savana on the east coast also showed that the throughput of September also dropped sharply to 436,300 TEUs, while in August, 575,500 TEUs decreased by more than 24%month -on -month. Virginia's import volume also decreased by 5.7%monthly, although the throughput of the port of South Carolina remained stable.

Usually at this time, with the Christmas season, a wave of strong exports, but the weak import of imports from the east and west coast of the United States also shows that Christmas products have been shipped in advance, and inflation has further suppressed consumer demand.

The Musen Ship, which reflected in the latest third quarter report of the Bandker Company, has always been focusing on the Pacific market transportation business. It is the first liner company to report to the same period of the same period last year.

The third-quarter performance trailer for the Musen Shipping Ship stated that the net profit of the marine transportation department was US $ 3.1-315 billion, while the same period last year was US $ 362 million, a year-on-year decrease of 14.9%; the second quarter was US $ 470 million, a 33%decrease from the previous month. Due to the plunge in the spot price of the cross-Pacific route, the Musen ship also announced that it had closed its China-California Express (CCX) service before the peak season. On the other hand, the CEO Matt Cox of the Musen ship was optimistic about the service, saying that the demand was "still stable" and optimistic that this service would last until 2023. Previously, due to the overflowing effect brought by the unaviability industry, under the current trend, it has transformed into a joint injury.

On the evening of October 25, the Box Corporation of the Boxing Company at the market supply chain of the transport industry released the first three quarters of the performance preview. 100 million yuan, a year -on -year decrease of 64%to 66%. As far as a single quarter is concerned, it is expected that the net profit of the mother in the third quarter is 461 million yuan to 661 million yuan, a year -on -year decrease of 85%to 90%. Zhongji Group also said that due to factors such as geopolitical events and overseas inflation, the demand for containers gradually returned to normal, which eventually led to a decline in performance.

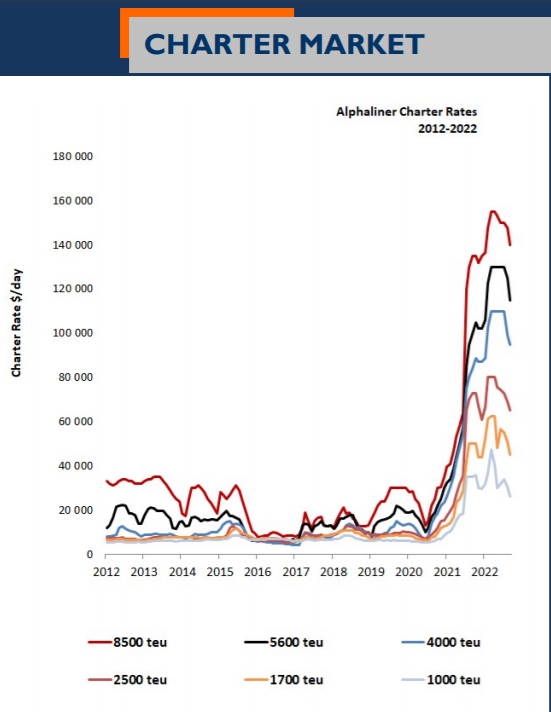

In the context of the decline in freight demand, most large shipping companies are reluctant to rent more ships. In this regard, the rental market is losing power. This pessimistic momentum is leading to the continuous weakness of container ships, the cost of sky -high rent is falling, and the lease period is becoming shorter. In the current market, the carrier company is generally only willing to give a maximum 12 -month rental period, and at the peak, this period can reach 60 months.

Nonetheless, the buying and buying of the cash flow head ship company could not stop. According to Alphaliner, the world's largest liner company Mediterranean Shipping has hired a shipyard to achieve a historic new construction plan, which will order 126 new container ships with a total capacity of nearly 1.8 million standard boxes. These ship orders are equivalent to 38.8%of MSC's current capacity of about 4.5 million TEU capacity. In addition to expanding the fleet and increasing the market's right to speak, MSC has recently built a new container terminal in Baltimore's port, and will further expand its US East Coast port assets. At the same time Rimorchiator Mediterranei.

The port ring (ID: gangkouquan) believes that, as a periodic industry, almost all liner companies in 2021 rolled over salted fish, ushered in unprecedented apex. More than the astronomical figures that exceed the sum of profit in the past ten years, the 40 -month -old annual award of the shipping company, who wants to take advantage of the airport IPO company, is undoubtedly a proof of the flowering industry. However, all signs are inevitably down after the "gold rush" of the industry -after the aperture. As for the phenomenon of illness, it is a gentle cycle or a gentle cycle.

Previous:What happened to the shipping market?

Next:Sudden! The country's 23 ports broke out!