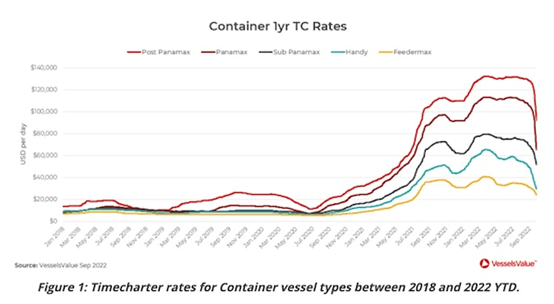

The current centralized market is in the adjustment stage. The concerns about the global economy have affected market emotions to a certain extent and led to decreased market demand. With the relief of the congestion of the port, the rental rate rate decreased.

VESSSELSVALUE data shows that the one -year lease level of the Panama (4250 standard box) ship reached the peak of $ 99,000/day in March this year; by the end of September, the rent had dropped to $ 51,000/day. The figure below shows the regular charter rate of all container ship types so far.

The price of container ships has risen steadily in the past two years, but starting in August this year, ship prices have fallen with the freight rate. For example, the price of a 5 -year -old Panama container ship fell from the highest point in April to US $ 118.91 million to $ 89.6 million at the end of September, a decrease of 25%.

Handheld orders and new ship prices

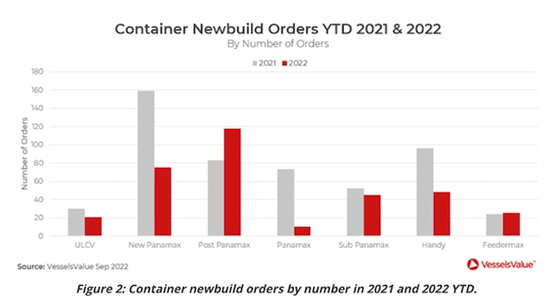

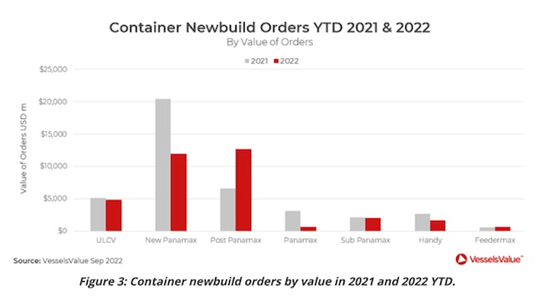

In 2021, the number of new container shipping orders reached 621 ships, equivalent to 3.9 million standard boxes. The demand for new shipbuilding this year has slowed down. So far, only 355 new ship orders are, almost half of last year. The figure below shows the price of new containers from 2021 and 2022.

The most popular ship type in 2021 is a new Panama -type ship with a load of about 15,000 standard boxes. And this year, the 7000-7800 standard boxes are more sought after by shipowners.

The average price of new ships in New Panamanian ships fell from US $ 281.3 million at the beginning of the year to US $ 2636.3 million at the end of September, a decrease of about 6%. The largest price decline was a 2000-3000 standard box, which has fallen 17.2%to $ 51.47 million since the beginning of the year. The figure below shows the comparison of the number of new container ships from 2021 and 2022.

Second -hand shipping market

From January to September 2021, there were 539 second -hand container ships, while only 270 ships were sold in the same period this year. Among them, second -hand ships traded 95 ships in the second quarter of this year, and only 46 ships were traded in the third quarter. MSC once again became the biggest buyer, purchased 7 ships, and Wanhai Shipping purchased 4 Panama -type ships.

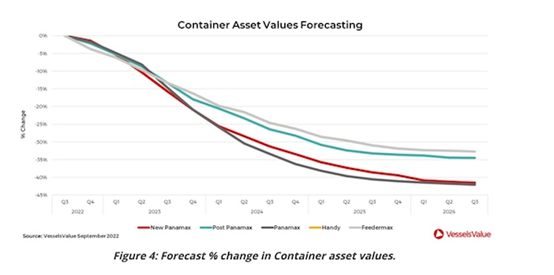

From a price point of view, comparison with the index level of the asset price of container ships in the first three quarters of 2021 is that the ship prices in 2022 have generally declined significantly. The figure below shows the prediction of the asset price of the container ship.

predict

After the strong performance of the first half of this year, the transport volume of the main routes is slowing. But in Asia, the market has shown signs of departure.

The growth rate of the fleet's capacity is still high. In July, the number of orders for handheld orders accounted for 30%of the existing fleet capacity, which is the highest level since 2008. The level of ship removal is very low, but it is expected that as the market is stabilized and the new rules of decarburization will take effect, the amount of shipping will increase significantly. It is estimated that after 2023, new shipbuilding demand will decline and prices will also fall.

Previous:TOP10-The top ten busiest container ports in the United States

Next:The industry is not good, and all aspects are not good