MSC confirmed on the 28th that MSC will "take certain measures" to rebalance its capacity, starting with the suspension of a complete route service, as the demand from the United States and the West from China has "reduced significantly". The major ocean carriers have so far been cutting capacity through an "air-to-air" strategy, but the rapidly deteriorating demand outlook over the past few weeks has forced major carriers to consider service cuts.

MSC said it would immediately "suspend" its transpacific to US West SEQUOIA service, which will be merged into 2M's Jaguar/TP2 service. To strengthen the Pan-Pacific route service network, MSC launched the sixth non-stop SEQUOIA/TP3 service to the US West in December 2016 to complement 2M's other five services on this route. According to the eeSea liner database, the loop deploys 11,000 TEU vessels between Ningbo, Shanghai and Los Angeles, and has signed a 10% space lease agreement with South Korea's SM Line.

Due to the slump in spot freight rates in the market, following the cancellation of its seasonal route China-California Express (CCX) by Matson Shipping last week, the suspension of the jointly operated TPX service by China United Shipping and Jin Jiang Shipping, and the closure of CMA CGM MSC is the latest shipping company to disclose the cancellation of the entire route after launching the "Golden Gate Bridge" (GGB) service.

"The decline in volumes and freight rates is forcing carriers to continue to cut capacity across the Pacific," Alphaliner said. The termination of service on the TPX line by China United Shipping and Jin Jiang Line, which have deployed two 1,868 TEU vessels between China and Los Angeles, means the latter "no longer has its own service in the Pacific".

Fast-expanding China United has taken steps to reduce its exposure on trans-Pacific routes, closing the TPN loop in August, although the company continues to operate its Trans-Pacific Express 11 (TPC), the Alphaliner consultant added. Serve.

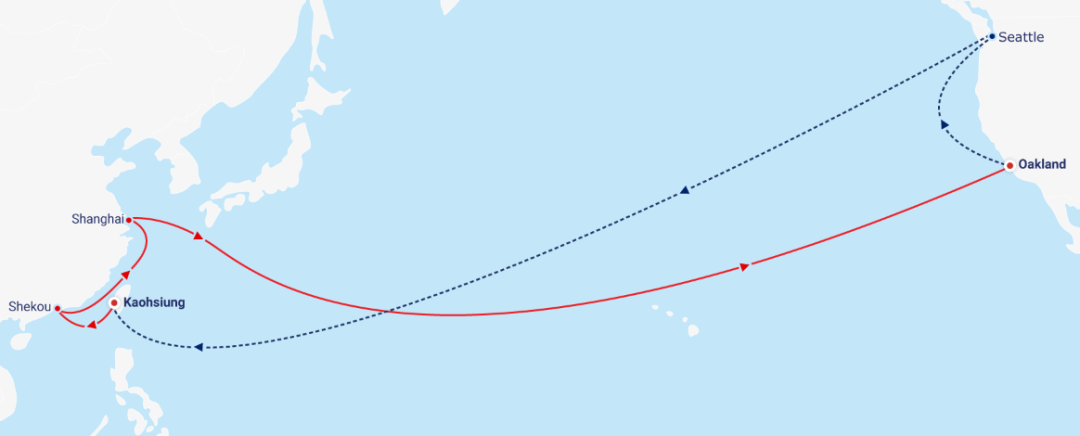

Meanwhile, Alphaliner reported that CMA CGM "is believed to be closing" its Asia-Western "Golden Gate Bridge" (GGB) service, which calls in Taiwan and China, with a fleet of up to seven ships , the capacity is between 5,000 and 11,000 TEUs. The 9415TEU "CMA CGM Medea" is currently on its final voyage (departing Shanghai on September 12), which will end after arriving in Shanghai on November 5, the company said. The calling port sequence of the cancelled GBB route is: Kaohsiung-Shekou-Shanghai-Oakland-Seattle-Kaohsiung.

Alphaliner added that China's Golden Week holiday in the first week of October, as well as the "generally subdued development of the freight industry", meant that shipping lines would cut capacity further in the coming weeks. "These cuts are also necessary to prevent further declines in spot rates," the consultant added.

In addition, MSC partner Maersk said in its latest report on Asia-Pacific markets in September that container shipping “faces strong headwinds” amid an increasingly pessimistic economic outlook. Maersk added: “Recent data shows that regional container growth rates have declined in most major regions, while container freight rates have fallen sharply.”

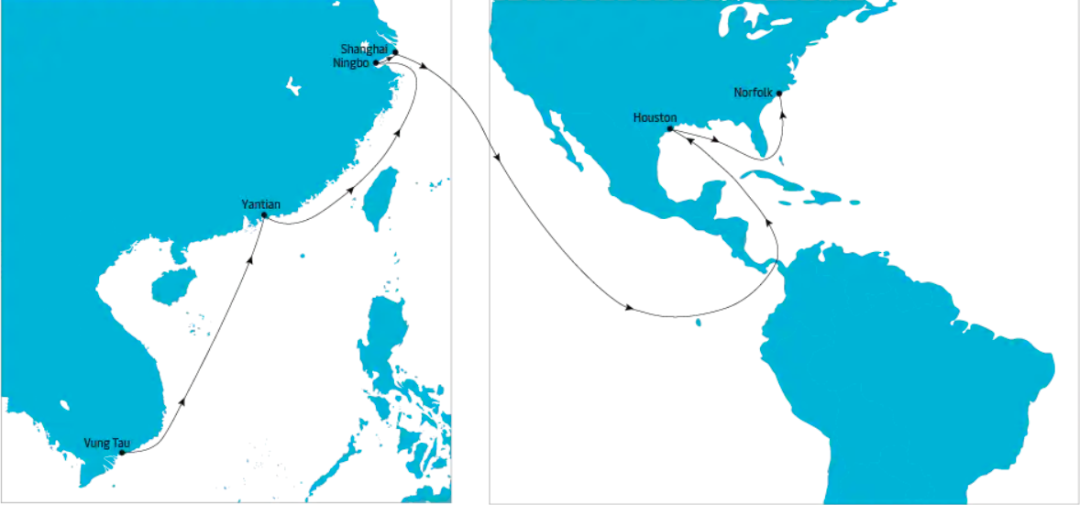

Maersk has suspended its Asia-U.S. East (USEC) service, a move that shows North American ports on the Pacific and Atlantic coasts are seeing less bookings for trans-Pacific carriers. Maersk announced that its 4447TEU 'Merkur Archipelago' serving the TP28 pendulum route will perform its final voyage in Vung Tau, Vietnam on October 13.

After that, the loop will be merged into Maersk's TP20 pendulum service, and the port order will be revised to: Jakarta-Vung Tau-Shanghai-Ningbo-Busan-Panama Canal-Mobile-Newark, returning to Jakarta via the Suez Canal. On October 16, the 4658TEU "Maersk Kentucky" made its maiden voyage. "We remain committed to shipping all Maersk contracted shipments through the Maersk Spot and Twill channels. We will restore capacity once demand picks up," the company said.

Demand for U.S. East Coast services has remained strong so far, largely due to congested cargo transfers at West Coast ports and concerns over new West Coast labor agreements. According to an analysis of the top 10 U.S. ports by John McCown, founder of Blue Alpha Capital, container imports at East and Gulf Coast ports rose 12% year-on-year to 1,187,095 TEU in August, while container imports at West Coast ports fell 11.5% year-on-year to 978844TEU.

Additionally, in August, New York and New Jersey officially overtook Los Angeles as the largest container port in the United States, with capacity increasing by 10.5% compared to last year to 441,511 TEU, while Los Angeles dropped 16.8% to 404,513 TEU. Congestion at U.S. ports has also shifted, with cargo moving to the east coast, with an average of 110 ships per month on the Atlantic side and only about 20 on the west, John McCown's report noted. Average congestion levels were highest in Savannah at 37, New York at 25 and Houston at 24.

Despite the congestion, ocean freight rates have been plummeting over the past few weeks, although not as fast as those in the US West, but compared with 12 months ago, the US East freight rate has fallen by about 65% to below $7,000/FEU, although still 50% higher than pre-pandemic shipping.

However, Maersk has apparently found that the 77-day round-trip voyage required to operate two 4,500 TEU Panamax containers, combined with waiting times, becomes uneconomical, especially in the absence of high-rate contract cargo and the need to replenish the spot to increase the loading rate.

Previous:The volume of goods and freight has dropped sharply! MSC, Dafei and other shipping companies have su

Next:The top ten judgments of global trade on the world's third largest shipping goods