Alphaliner introduced in its weekly market report released on Wednesday that since the Shanghai Container Freight Index (SCFI) reached a record high of 5,110 points at the beginning of this year (January 7), the spot ocean freight rate for containers exported from China has been consistently high. in steady decline.

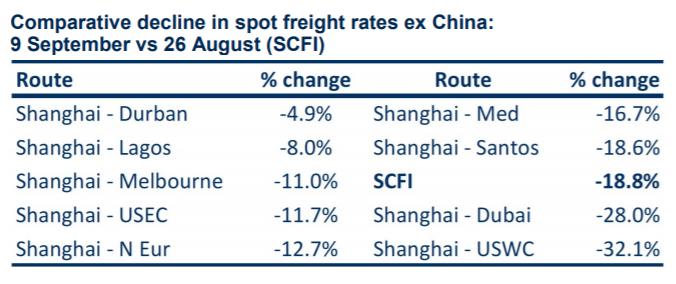

At the beginning of September, the downward pressure on the container spot freight rate increased significantly, and the spot freight rate index published by the Shanghai Shipping Exchange fell by no less than 18.8% from August 26 to last Friday (September 9).

The largest drop in spot freight rates on the east-west route was the Shanghai-California route.

ALphaliner explained that the route attracted a lot of extra space/capacity and many new shipping lines last year as it was the most lucrative trade route on average per nautical mile last year.

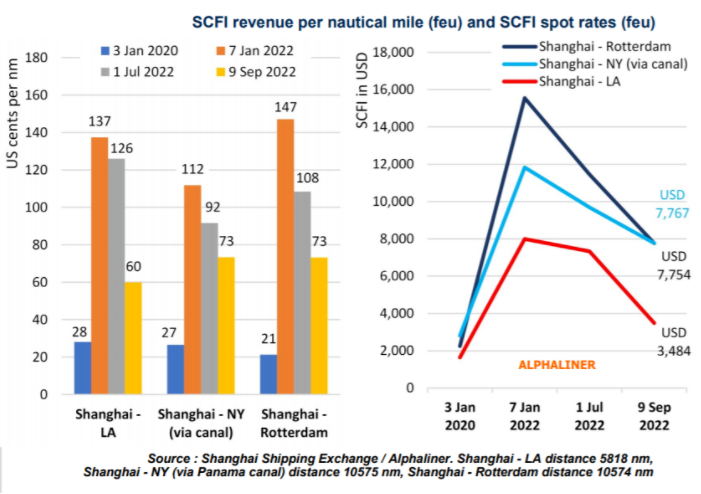

Revenue per nautical mile on this route has now fallen to 60 cents as container spot rates from Shanghai to California fell below $3,500/FEU last week.

That figure represents a more than halving since early July (126 cents), when the revenue was still attractive for ocean carriers as it was only about 11 cents below its peak at the start of the year.

Alphaliner said that although such an income level of 60 cents/nautical mile is still double the pre-pandemic level of 28 cents/nautical mile in January 2020, the rapidly declining spot freight will be some new entry on this route. The biggest worry for shipping companies and those logistics companies who pay high prices to charter ships to invest in this route. Because these companies rely more heavily on the spot market.

Alphaliner said that the main reason for the decline in spot freight rates was weak demand for goods. Significantly higher energy costs and high inflation will clearly further impact consumer spending.

It took nearly seven months for the SCFI index counted by Alphaliner to fall from a peak of 5,110 points to less than 4,000 points in July this year (July 22). However, just 6 weeks later (September 2), the index fell below 3,000 points, the first time since April 2021 that it has fallen below 3,000 points.

In addition, spot rates on the route from the Far East to the US East Coast have also declined, but the route has declined gradually since the beginning of the year and has not experienced a sharp decline of the same magnitude as to the West Coast in the past few weeks.

The fall in rates on the Far East to US East Coast route has had less of an impact on the market mainly because heavy congestion on the East Coast has made ships actually busier than their schedules indicate.

Average earnings per nautical mile from Shanghai to the U.S. East Coast have fallen from 112 cents in January to 73 cents today.

The revenue per nautical mile from Shanghai to New York (via Panama) is equal to the revenue per nautical mile from Shanghai to Rotterdam, and the distance traveled is almost the same.

When zooming in on the relative decline in containerized spot freight rates for Chinese exports over the past two weeks (see table above), it is clear that freight rates on the China-U.S. West Coast and China-Middle East routes have been hit the hardest. They were down 32, 1% and 28%, respectively.

Previous:Rents are down! In the container ship market, defaults begin to appear~

Next:"Hard landing" in the container shipping market? Reduced demand and severe excess capacity