Some owners will have to face the cancellation of their charters as rental rates in the container ship market begin to decline.

Hire rates for sky-high container ships begin to slide

In a market report last week, Alphaliner, a well-known consultancy in the container shipping sector, said demand was becoming an issue in the container ship charter market.

The agency further explained that most major shipping companies are reluctant to charter more ships against the backdrop of declining freight demand. In this regard, the recovery in capacity that has begun to appear in the spot market (albeit limited at this stage) suggests that the market is losing momentum.

According to Alphaliner, this pessimistic momentum is leading to continued weakness in container ship rental rates and shorter charter periods.

The French consultancy went on to say that with the exception of one carrier company, no major charterer is currently willing to make multi-year charter commitments for spot capacity.

In the current market, carrier companies are generally only willing to give a lease term of up to 12 months, and at the peak, this term can reach 60 months (5 years).

Under such circumstances, current container charter prices are continuing to weaken across the board.

A fat contract expires

The lapse of a recent lease that was suddenly interrupted can also reflect the state of the market from the side.

The charter involves a 2005-built 1,740-teu vessel called Green Ace, owned by Norwegian ship Frederiksen's SFL Corp.

In August this year, the ship was originally leased to Allseas Shipping, a newly established container shipping company of a British freight forwarding company, with a lease term of nearly 50,000 US dollars per day for two years.

But the latest news is that the ship has been leased to another carrier called Aladin Express, with a shorter lease term of 60 days and a lower rent of only $23,000/day.

According to sources familiar with the deal, the ship is no longer needed because of Allseas' lower-than-expected cargo volumes.

As previously reported by Xinde Maritime Net, "The first in 40 years! Another container shipping company was born, chartering ships crazily and planning to build ships". In order to better control its own space and schedule, a British freight forwarding company named DKT Allseas established its own shipping company.

It had originally planned to charter the Green Ace for its Asia-Europe route.

However, trade routes from Asia to Europe have suffered from lower volumes and lower freight rates in recent weeks. Freight rates from Asia to Northern Europe also fell to $7,878 per 40-foot container this week, about 25% below the levels seen between May and early August.

Analysts say ocean-going lines are canceling flights to keep ships fully loaded.

Transpacific rates fell even more sharply. This week, shipping rates from Asia to the US West Coast fell to $3,973/feu, compared to $20,586/feu a year ago. It even raises concerns about the future of other new shipping lines trading between Asia and North America.

Shipowner: Don't panic, the market is still high

It is important to note, however, that despite the drop in container freight rates, ocean freight rates are currently well above normal levels.

According to Freightos estimates, container freight rates on the trans-Pacific route are still roughly three times their September 2019 levels, and rates from Asia to Northern Europe are five times higher.

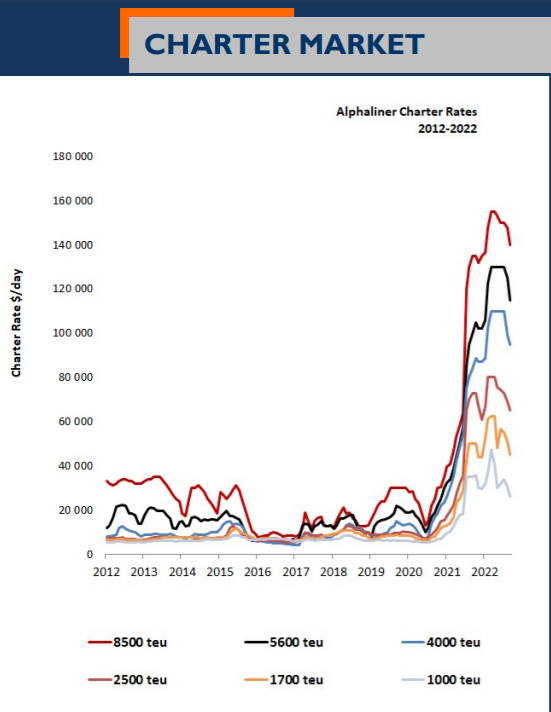

In terms of container ship rentals, as shown in the chart drawn by Alphaliner at the head of this article, although the rental level of container ships is falling, most of the size of the ships remain at a relatively healthy level. Alphaliner also expects that the rental of container ships will be in the short term. China will remain strong due to continued limited supply of tonnage (capacity) and ongoing disruptions to global logistics chains.

Constantin Baack, CEO of container ship owner MPC Container Ships (MPCC), said at a conference on the current downward trend in container ship rents, "Our market has been at an all-time high before, and it is normal for a little correction now."

"Overall, we're still in a very strong market environment," Baack said. “There are usually 1,500 ships available in the charter market, and next year there will be only 400-450 ships on the market, which is still a relatively small number.”

Baack also conceded that the sublease of ships in the market could increase the supply of container ships. But he added that subletting of vessels in the container shipping industry is still more difficult than in other segments of the shipping industry.

Previous:Falling freight rates will put pressure on operations, but don’t be too pessimistic

Next:"China-US-Western route is no longer the most profitable route"