It is reported that according to a report recently released by Ti Research, the global freight forwarding market will rebound strongly in 2021, with an actual growth of 11.2%, achieving the highest growth rate since 2011, with a market value of US$284.9 billion. Among them, the freight forwarding market in the Asia-Pacific region has the highest growth rate, reaching 13.8%, accounting for 34.9% of the global market.

According to data from the United Nations Conference on Trade and Development, the global trade volume in 2021 will reach a new high of about 28.5 trillion US dollars, an increase of nearly 13% from before the epidemic. The strong growth in international trade in 2021 is mainly due to the phasing out of COVID-19 restrictions, as well as a surge in demand for commodities, encouraged by government support programs and economic stimulus packages introduced in many countries, the Ti report noted. Factors such as the expansion of the e-commerce industry and the rise of free trade agreements have also contributed to the growth of the global digital freight forwarding market.

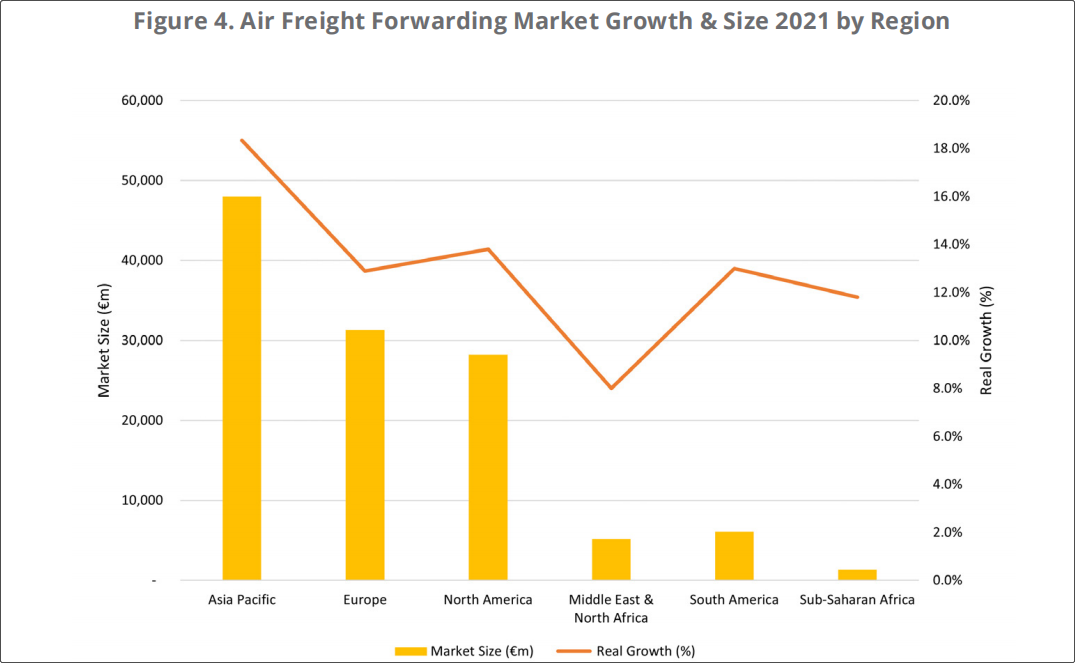

In 2021, the growth rate of the air freight forwarding market is more than double that of the ocean freight forwarding market. The air freight forwarding market grew in real terms by 14.9% to a par value of $128.2 billion. Ti said the growth was driven by strong demand for goods, including COVID-19 protective equipment, which is often transported by air, and bottlenecks in supply chains by sea and land.

▲In 2021, the growth and scale of the air freight forwarding market in various regions

The yellow bar represents market size, and the orange line represents market growth

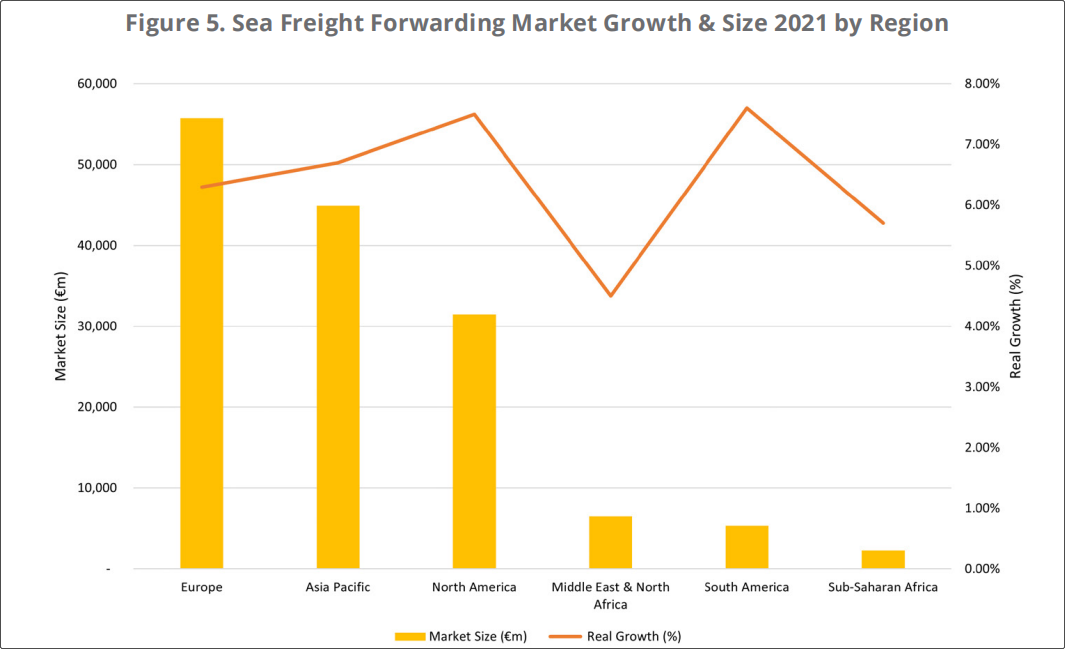

▲Growth and scale of shipping agency market in various regions in 2021

Port congestion creates a mismatch between supply and demand and slows the growth of the maritime market. For example, according to Maersk, around 12%-15% of the world's container ship capacity in 2021 will be put on hold due to congestion. According to Kuehne+Nagel, 80% of global shipping disruptions are related to North American ports.

Congestion in the ocean freight market continues to push traditional ocean shippers into the air freight market, increasing air freight demand and pushing up air freight rates. The spread between air and ocean freight has narrowed over the past year, making the switch to air freight slightly less expensive than it was before the pandemic. Before the pandemic, the average price of global air freight was 12 times that of sea freight. By the end of 2021, the cost of air freight is about 2.5 times higher than it was before the pandemic.

Congestion at sea and port terminals shows little sign of improvement for now, so air freight will continue to be the option for shippers to address critical supply chain delays.

However, while economic indicators point to continued strong demand for air cargo, capacity constraints will result in lost growth opportunities. Although airfreight capacity gradually increased in 2021 due to improved international passenger traffic, it was still 10.9% lower than in 2019.

In addition, global trade growth is expected to moderate in 2022 as the drivers of growth momentum are likely to taper off, the report said. As the global economic recovery continues but weakens, the global freight market is expected to grow at a slower pace (5.7% in real terms) in 2022, with a market capitalization of $300.59 billion.

In 2022, the air cargo industry will partially return to a more normal state, but growth will still be stronger than usual, causing the air freight forwarding market to grow faster than GDP and trade. The ocean freight forwarding market will have to endure a more challenging few months due to undercapacity, as most of the new capacity will not come online until 2023.

Previous:Evergreen surpasses ONE to become the sixth largest shipping company in the world

Next:Los Angeles: Thanks to Ningbo-Zhoushan Port, our cargo flow has not been affected by the closure of