Many sellers can’t tell where the changes to the new tax law are. Today we will tell you what the IOSS and OSS are after the implementation of the new policy.

shipping from china to fba

Detailed explanation of IOSS and OSS

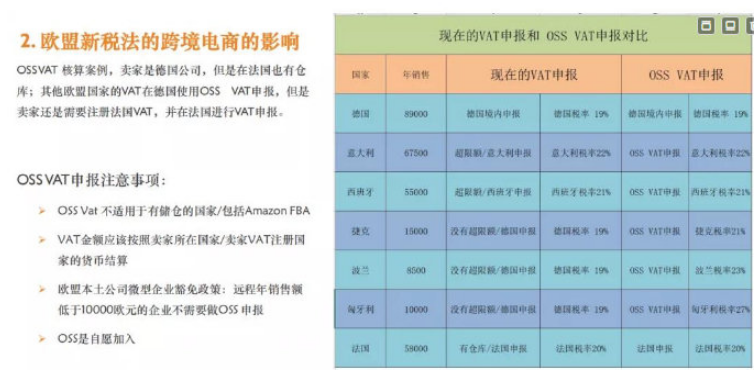

OSS (The Union One-Stop Shop): It is the EU's one-stop VAT electronic filing system. OSS VAT is a new tax law system implemented in order to reduce tax fraud in the e-commerce industry in EU countries, simplify the VAT declaration process and protect the fair competition of local companies. The OSS declaration system will be implemented on July 1.

OSS will apply to the declaration of VAT for remote sales of products within the EU. When shipping from the EU to buyers in the EU, you can choose how an EU country uses the OSS system to apply for all 27 EU countries. Companies outside the EU are no longer affected by the distance sales quota, and VAT calculations are carried out in accordance with the tax rate of the receiving country. For local companies in the EU, the EU distance sales are 10,000 Euros (including all 27 EU countries). The OSS VAT declaration is a voluntary registration.

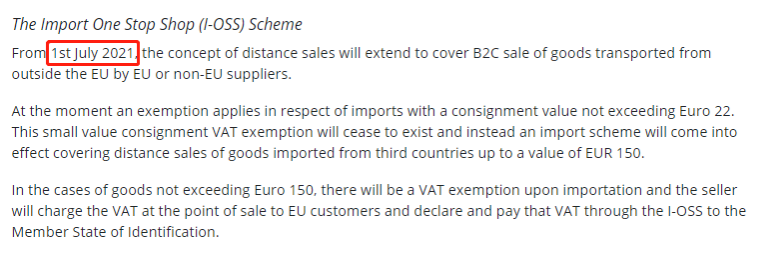

IOSS: It is The Import One-Stop Shop, which means import one-stop VAT electronic declaration system. Starting from 2021.07.01, the EU abolished the tax-free quota for imports below 22 euros. E-commerce platforms must collect VAT value-added tax from buyers when goods are sold, and declare VAT value-added tax every month through IOSS. IOSS VAT declaration is only for goods with a value of less than 150 euros. For example, if our Chinese sellers self-deliver to EU buyers, they need to use IOSS to declare.

shipping from china to fba

The changes in this new policy are still very far-reaching. Both self-delivery sellers and FBA sellers will be affected. Let me talk about several important changes in detail.

Significant changes after the VAT New Deal

1. Europe will abolish the welfare policy of exempting import VAT tax under 22 euros. From July 1, all goods with a value of less than 150 euros must be declared for VAT through IOSS. The seller needs to affix the IOSS number on the self-delivered package.

2. E-commerce platforms are regarded as sellers and need to bear tax obligations. Therefore, in order to reduce their own risks, e-commerce platforms start from 2021.07.01: the platform implements a withholding and payment system for selling VAT. According to the regulations, the seller is still the owner of the goods. Although he does not need to pay taxes himself, he still needs to make a normal VAT declaration.

3. The VAT declaration process is simplified, and it is no longer necessary to record the remote sales quota. Chinese sellers only need to register the VAT number of the country where the goods are stored.

shipping from china to fba

shipping from china to fba

One exception is that sellers whose companies are registered in the European Union can still enjoy a tax exemption of 10,000 euros for distance sales. If they exceed the limit, they need to apply for the OSS system for tax declaration at the place of registration.

In the past, many self-delivery sellers thought that there are remote sales thresholds and tax exemptions. European sites do not require strict VAT tax numbers for self-delivery, and they can sell quietly without a registered tax number. However, the new tax law directly cuts off remote sales. Sales threshold and tax exemption policy, self-delivered goods with a value of less than 150 euros and FBA will all be paid and deducted by the platform by VAT.

Taxation in Europe is now becoming more and more unavoidable. This tax reform has completely plugged some small loopholes in tax avoidance by sellers, making the tax compliance of European stations close to perfect. Although the cost of VAT is placed here, the European station still has a large market and high consumption, and there are some tough policies against Amazon, which are all advantages of attracting sellers to enter the European station. Now that taxation is becoming more and more compliant, it is necessary to consider how to solve the tax problem in Europe.

shipping from china to fba