Shipping companies have long used air to match capacity with demand, but for most of 2020 and 2021, shipping companies struggled to maintain capacity to meet skyrocketing demand, which resulted in overcrowded ships and congestion at ports and terminals , which means that the shipping company cannot guarantee the stability of the shipping schedule and can only be forced to fly by air.

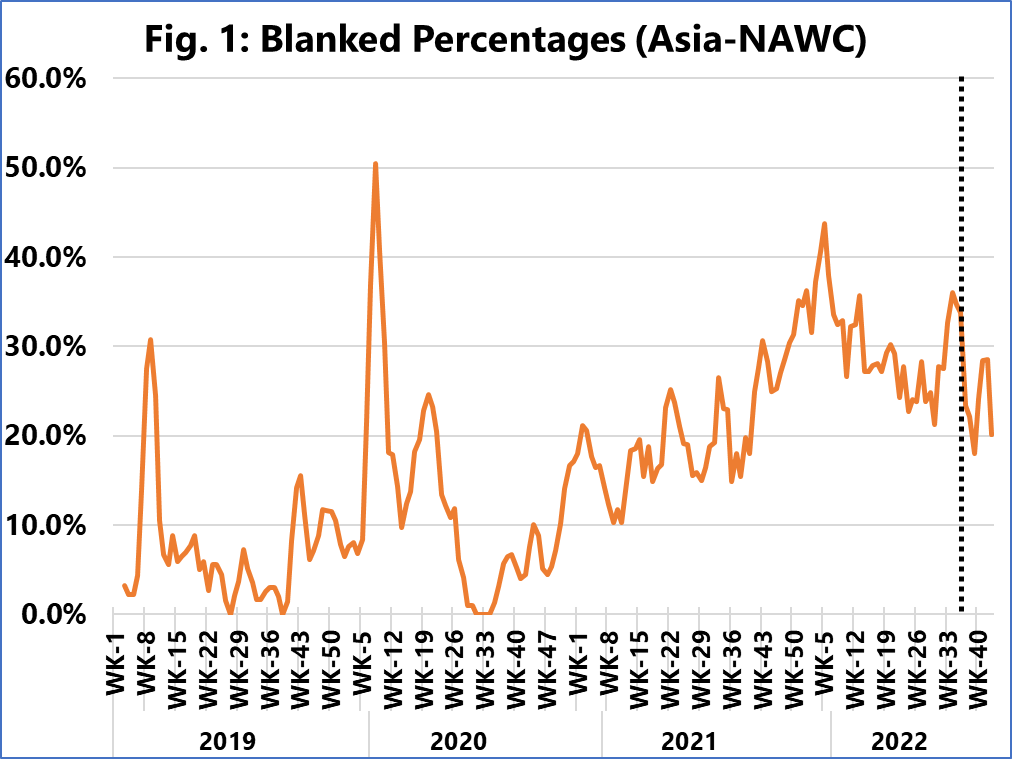

Over the past few months, however, freight demand has been stagnant, ships are underutilized, and freight rates have continued to plummet. At this time, shipping companies will naturally take tactical air travel to prevent the decline in freight rates. With the arrival of China's Golden Week (starting on October 1), shipping companies have a good opportunity to deploy more air services, reduce pressure from cargo owners, and maintain freight rates by cutting capacity.

Sea-Intelligence's statistics on the deployment of ships by shipping companies in the coming weeks. On transpacific routes, capacity reductions will be 22%-28% of weekly deployed capacity in the weeks following Golden Week, compared with peaks of 15%-17% in these weeks of 2019, and average 2014-2018 9%-11%. Figures were also higher on the Asia-Nordic route, with capacity cuts peaking just under 20% after Golden Week, which, while in line with 2019, is higher than the 2014-2018 average. On the other hand, the Asia-Mediterranean route is the only one of the four trade lanes to see capacity reductions during the 2022 Golden Week, in line with 2014-2019.

Previous:The largest container port in the United States, the import volume in August fell by nearly 17% year

Next:15 weeks in a row! Is the container freight rate expected to stop falling or even rise in October?