Recently, the freight rates of the main shipping routes in the container shipping market have continued to decline.

As of September 9, 2022, the Ningbo Export Containerized Freight Index (NCFI) closed at 1,910.9 points, down 53.7% year-on-year and 11.6% month-on-month. Since mid-June, it has fallen for 13 consecutive weeks. Since July, the decline has continued to expand, falling 55.2% from the high at the end of 2021.

Among them, the freight rate of the Thailand-Vietnam route has dropped since the beginning of June. The current market average price of a 40-foot TEU is only US$174/FEU, which is about one-twelfth of the early June and about 18% of the highest value in 2021. It is even lower than the freight rate before the epidemic.

The author believes that the rapid decline in the freight rate of the Thailand-Vietnam route is mainly due to the weak demand for freight on the route and the expansion of the superimposed available capacity, resulting in an imbalance between supply and demand.

Traditional off-season overlay

Decrease in European and American orders

June-September is the traditional low season for Thailand-Vietnam routes.

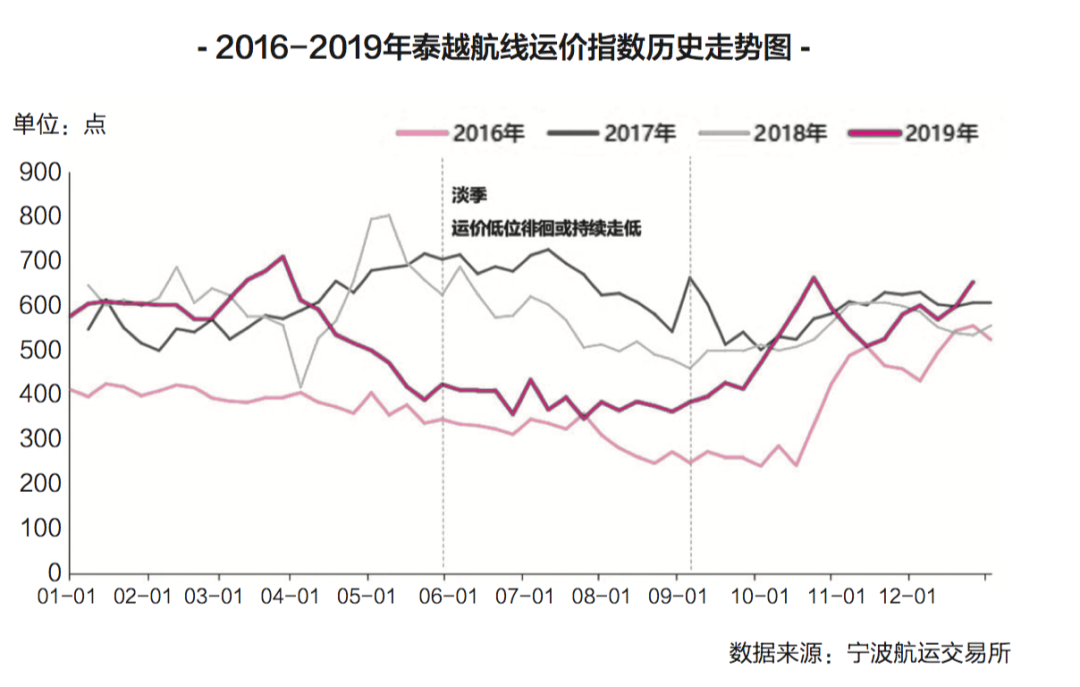

According to the 2016-2019 NCFI Thailand-Vietnam route freight index trend, during this period, the freight rate will hover at a low level or continue to decline every June to September. Since June 2022, an important factor for the accelerated decline of freight rates on this route is that Thailand and Vietnam have entered the rainy season, with frequent torrential rains, and local transportation and enterprise production have been negatively affected.

From the import trade of Thailand and Vietnam, China is the largest source of imports for Thailand and Vietnam. Thailand and Vietnam import primary products from China, which are processed and then exported to European and American markets.

The data shows that from January to July 2022, the volume of goods imported from China accounted for 23.1% of the sources of imports from Thailand and 33.1% of the sources of imports from Vietnam. Among them, 29.2% of Vietnam's computer/electronic products and parts, 53.4% of mechanical equipment, 39.7% of mobile phones and parts, 52.3% of textiles/leather and footwear materials are imported from China. 27.2% of computer/electronic products, 50.1% of textiles, 44.5% of machinery and equipment, 23.7% of mobile phones and parts, etc., were exported to the United States.

In July, Thailand’s total exports were US$23.63 billion, up 4.3% year-on-year, an increase of 11.0% month-on-month, the lowest since December 2021; Vietnam’s total exports were US$30.61 billion, up 12.3% year-on-year, the highest increase since November 2021. Low, down 6.8% month-on-month.

Among them, the trade volume of Vietnam's mobile phones and parts only increased by 4.7% year-on-year, down 16.8 percentage points from the first half of the year; the trade volume of computer/electronic products and components increased by 14.3% year-on-year, down 4.4 percentage points from the first half of the year; textile/leather The trade volume of and footwear materials increased by 9.1% year-on-year, down 15.3 percentage points from the first half of the year, and the export growth rate dropped significantly.

The purchasing capacity of major consuming markets such as Europe and the United States has declined, leading to a weakening of the demand for imported primary products from Thailand and Vietnam to China.

On the one hand, since 2022, the major consumer markets such as Europe and the United States have been stimulated by the conflict between Russia and Ukraine, and economic inflation has been high. The consumer price index (CPI) of the United States and the euro area has increased significantly. The current year-on-year growth rate has reached 8.3% and 9.1% respectively. %, higher than the index growth rate after the 2008 international financial crisis, an increase of 2.7 percentage points and 5 percentage points respectively. Consumers are more cautious about the consumption of non-essential items such as electronic products, clothing and accessories, furniture and bedding, and are more willing to buy food, energy and other daily necessities.

On the other hand, large international retailers and some manufacturers have high inventory rates, and the demand for restocking and manufacturing has declined.

For example, Walmart's inventory rose 25.5% year-over-year in the second quarter, sales rose only 6.5% year-on-year, and billions of dollars in orders have been cancelled. Meanwhile, Walmart, Target and others are slashing prices on products such as clothing, kitchen appliances, garden furniture and bicycles. Samsung Electronics, a major global buyer, has also scaled back production at its smartphone factory in Vietnam.

Due to insufficient transportation demand, the freight rates of major ports in Thailand and Vietnam to Europe, the east of the United States, and the west of the United States dropped sharply.

Data shows that as of now, the freight rates from Ho Chi Minh (Vietnam) and Laem Chabang (Thailand) to Los Angeles (West America) are both less than US$5,000/FEU, down 62.5% and 71.1% respectively from mid-December 2021; exports to The freight rate in New York (East US) is less than US$9,000/FEU, down 46.2% and 53.1% respectively compared with mid-December 2021; the freight rate for exports to Hamburg (Europe) is around US$7,000/FEU, which is lower than that in 2021. In mid-December, they fell by 49.4% and 54.0% respectively.

Increased capacity and low-cost collection

"Zero Tariff" and "Negative Tariff" Reappear

In fact, before the epidemic, the market capacity of the Thailand-Vietnam route was in a state of excess, and the freight rate has been in triple digits for a long time. In 2021, due to the reduced efficiency of transportation capacity turnover and the surge in procurement demand in Europe and the United States due to the epidemic, the entire shipping market will be in a state of space shortage, which will drive the freight rate of the Thailand-Vietnam route to the highest level since March 2012.

Since 2022, as the epidemic is gradually brought under control, the capacity turnover efficiency has gradually improved, and the overall available capacity in the market has increased.

Sea-Intelligence data shows that the average ship delay time in July was 6.2 days, a 21% reduction from the average delay time of 8.0 days in January; the reliability of the ship schedule increased to 40.5%, compared with 30.4% in January, an increase of 10.1 percentage points . This means that more capacity can be used by the market. In the context of the increase in available capacity, although liner companies are actively taking measures to suspend sailings, combined with the impact of declining demand, the supply of capacity on various routes is still in excess.

The same is true for the Thai-Vietnamese route. The shipping capacity on this route due to congestion and delays in the past has been released more, and at the same time, European, North American and other routes no longer need to temporarily call ships on the Thai-Vietnamese route.

In addition, in June 2022, the box Dong (box owner) ship will be put into the Thailand-Vietnam route in the form of an overtime ship. At the end of June, COSCO SHIPPING Lines launched a new 1,000TEU vessel on the Thailand-Vietnam route. The sudden increase in capacity and the slowdown in demand have led to a rapid deterioration of the supply-demand relationship on the Thailand-Vietnam route.

The emergence of "zero freight rate" and "negative freight rate" is mainly due to the unprecedented prosperity of the container shipping market since 2021. Liner companies have further increased their right to speak in the container shipping market, and some freight forwarders are too optimistic about the future market. At the same time, in order to consolidate the cooperative relationship between itself and the liner company, it has formulated a higher freight volume index.

However, the current market situation is not optimistic. Under the circumstance of serious oversupply, freight forwarding companies can only increase the sales price at a price lower than the cost freight rate of the liner company in order to complete the freight volume target set by the liner company at the beginning of the year. There are cases of "zero freight rate" and "negative freight rate" on the route.

At the same time, some small liner companies that entered the container shipping market after the epidemic, in order to improve their ability to collect cargoes and compete at low prices, also lowered the overall freight rate level of the market.

global economic downturn

Shipping rates continue to drop

The World Bank's "Global Economic Outlook" report released in June 2022 pointed out that the global economy may enter a "stagflation period" of "low growth and high inflation". The Global Economic Outlook report also lowered its forecast for global economic growth in 2022 to 2.9%, well below the 4.1% expected at the beginning of the year.

At the same time, the pace of interest rate hikes by the Federal Reserve has accelerated, and it is expected that there will be more than two rounds of interest rate hikes before the end of 2022. The European Central Bank also raised interest rates for the first time in 11 years, a historic 75 basis points.

Market worries about the escalating stagflation risk and weak economic growth continue to intensify. Combined with the impact of the conflict between Russia and Ukraine, European and American buyers are cautious about investment and consumption, and the phenomenon of delaying and canceling orders may continue.

In terms of capacity supply, port congestion and ship delays have accelerated under the background of weakening overseas demand and the liberalization of epidemic prevention policies. The market may experience slow peak seasons and prolonged off-seasons.

As the overall freight demand on the Thai-Vietnamese route is less than 10% of the overall seaborne export demand for containers, the freight rate on the Thai-Vietnamese route is more susceptible to the adjustment of capacity supply.

Due to the short voyage of the Thailand-Vietnam route and the relatively low management requirements of the destination port, the operating costs and entry barriers of the liner companies participating in this route are relatively low, and there are relatively more liner companies operating. Excluding the impact of the epidemic, ocean freight rates have been at a low level for a long time, so in the case of a sudden imbalance between supply and demand, freight rates have fallen significantly.

At present, freight forwarders can temporarily bear the operating losses under the "zero freight rate" and "negative freight rate" of the Thailand-Vietnam route, but the market may be difficult to bear the operating losses of "negative freight rate" and "zero freight rate".

Previous:"Hard landing" in the container shipping market? Reduced demand and severe excess capacity

Next:Matson cancels China-California Express (CCX) service, last voyage has ended