According to analysis and calculations by shipping analyst Alphaliner, the transatlantic route has replaced the transpacific route as the most profitable trade route.

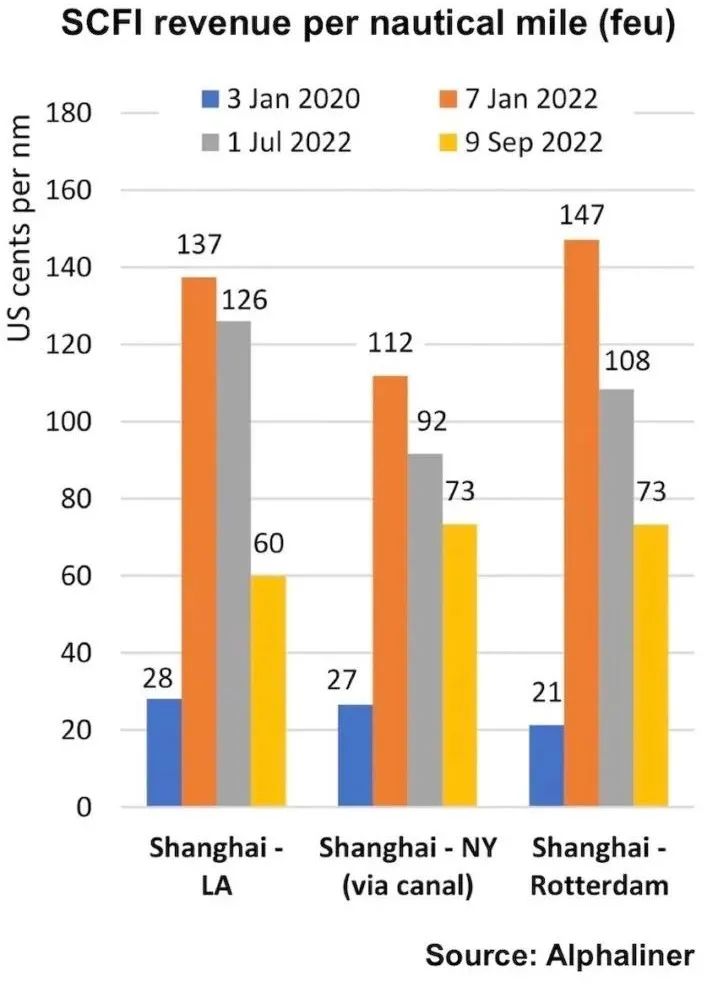

The latest research from Alphaliner pointed out that the Shanghai Container Freight Index (SCFI) shows that the spot freight rate from Shanghai to Los Angeles has dropped to US$3,500/FEU, a drop of about 32% in just two weeks, which means that shipping companies per nautical mile per mile. The FEU earned 60 cents, less than half the 126 cents per nautical mile recorded in July.

According to Alphaliner, the Shanghai-New York and Shanghai-Rotterdam routes both currently earn 73 cents per nautical mile, while the transatlantic route from Rotterdam to New York is earning 217.9 cents per nautical mile. This difference may have led shipping companies to deploy larger ships to transatlantic routes.

Spot rates in Asia-US East and Asia-North Europe saw similar (albeit smaller) declines, at around 73 cents per nautical mile.

Alphaliner points out in its latest weekly report that it would be well worth moving the additional ships to the Nordic-US East route, which may explain why COSCO decided to use the larger 13092TEU "COSCO Harmony" on Ocean Alliance's TAT2 loop. It replaces the 8063TEU "OOCL Shekou", however, this trade route also requires additional capacity to deal with the impact of port congestion.

The Alphaliner report said the slump in spot freight rates on the trans-Pacific route was a “major concern” for newcomers to the route. This route was the most lucrative for much of the post-pandemic period.

At the same time, Alphaliner also warned that deteriorating conditions on the trans-Pacific routes could hit independent shipping companies far more than members of shipping alliances because of their greater reliance on chartering and spot freight rates.

“While average earnings of 60 cents per nautical mile on transpacific routes are still more than double pre-pandemic levels (28 cents in January 2020), the rapid decline in spot rates will hurt newcomers and non- Alliance shipping companies because they have very expensive ships in the charter market. “These shipping companies are usually very reliant on the spot market.

Linerlytica, a liner data provider, noted in a report this week: “Several new entrants into the Asia-Europe and trans-Pacific markets have substantial tonnage commitments that will prevent them from easily removing their ships in the short term. ."

And Alphaliner has previously said the industry will experience an expanding two-tier market, divided between those who sign long-term contracts at higher prices and those who rely on a weak spot market.

Previous:Shipping prices upside down! The price war is coming

Next:Falling freight rates will put pressure on operations, but don’t be too pessimistic