Why container freight rates are falling sharply, while container shipping companies are still paying high prices to expand capacity. The entry into force of environmental regulations may be one of the main reasons.

Container ships still have value

Although the container spot freight rate has fallen sharply, there are still container shipping companies willing to spend a lot of money to buy second-hand container ships recently.

According to the latest information from Xinde Maritime.com, the Greek shipowner company Cosmoship Management has recently sold a 1740TEU small container ship named Kalliroe built in 2011, and the price is still as high as 35.4 million US dollars.

Preliminary sources said that the buyer of the vessel was neither MSC, CMA CGM nor Maersk, but a Central Asian shipping company.

According to the information provided by Alphaliner to Xinde Maritime Network, two other small container ships of 1708TEU named A Kibo and A Roku also changed hands today, and the price was also as high as 30 million US dollars. The above two ships were built in 2008 and are older.

Also according to brokers, another 2007-built 1,706TEU Songa Ocelot was recently sold for $30 million.

Another example is the recent report of Xinde Maritime Net "Container Freight Continues to Fall! Why are large container shipping companies still chartering + buying at high prices? ”, recently, shipping companies including MSC, CMA CGM, ONE, etc. are still expanding their shipping capacity by buying ships and chartering ships.

Take CMA CGM as an example, the company is still buying second-hand ships at high prices recently.

It is reported that the company recently purchased a 3884TEU, 2013-built Cap Capricorn from Israel's XT Shipping for a price of up to $75 million!

In addition, MSC, which has been madly renting and buying container ships in the past two years, is still searching in the market.

It is rumored that MSC is about to complete the acquisition of two container ships, both 9403TEU named Judith Schulte and Johanna Schulte.

Both vessels were built in 2013, and MSC expects the cost per vessel to be substantial.

If you can’t buy a ship, you can also rent a ship at a high price. It is said that ONE has leased two large container ships of 6500TEU under Costamare at a rental level of 59,000 US dollars per day. The lease period is as long as 3 years, and they can only arrive Shipped early next year!

Both vessels were built in 2004, the 6,492-teu Aries and Argus, due for delivery until next year, in February and April respectively.

While this rent level is slightly lower than previous similar transactions, it is still an all-time high.

At the same time, CMA CGM has recently renewed the charter of four traditional Panamax ships at a high price, with a lease term of up to 60 months, and the rental level is believed to be US$39,000/day. One of them can be delivered in December this year, while the other three will not be delivered to the flyers until January next year.

Further sources said the four vessels are the 4,363-teu GSL Susan (built 2008) owned by New York-listed Global Ship Lease (GSL), and the 4,298-teu CMA CGM Jamaica 4,043-teu CMA CGM Sambhar built in 2006 and CMA CGM America.

The current charter levels for these four vessels are only between $22,000 - $25,350. Apparently, the price has nearly doubled after the renewal.

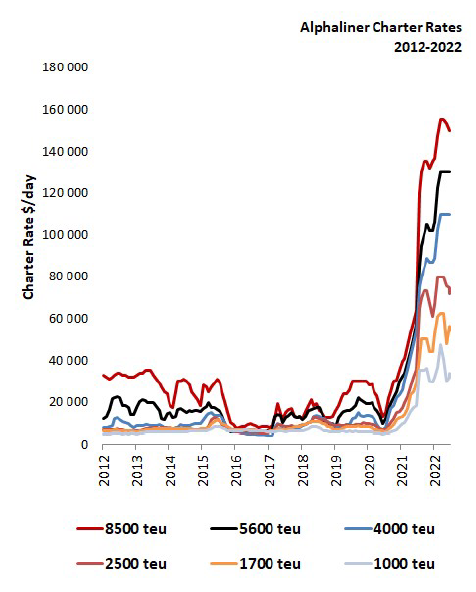

Data assessed by Alphaliner shows that while current container vessel rates have fallen slightly, they are still at historic highs

Clarkson also said in the recent market weekly report that due to the limited trading capacity currently available in the market, although the container spot freight rate has dropped sharply recently, the rental level of container ships remains high, a 2750TEU linear container. The 6-12 month charter period of the vessel can still reach $80,000/day.

Shipowners reveal the answer

The container leasing market remains positive and the market is likely to see a new peak this year, Dr. John Coustas, chief executive of independent container ship owner Danaos, said on the company's second-quarter earnings call this week.

Dr Coustas explained that as new environmental regulations come into effect, container lines are required to "redesign the routes they operate at lower speeds to ensure they do not violate relevant requirements and to assure customers that they are actively reducing CO2 emissions" .

It believes that only half of the current global fleet, or about 6,000 container ships, is expected to meet the IMO's carbon intensity index (CII) requirements in January, meaning these ships will need to slow down to meet the relevant requirements.

“While it remains to be seen how the CII will ultimately be implemented and how the timeline for compliance will be structured, carriers are actively considering options to adjust their line services by bringing in more vessels.”

According to Maersk CEO Soren Skou, the Danish shipping company estimates that based on the current size of its 700-ship liner fleet, it needs to add between 5% and 15% in capacity to meet CII regulations Guaranteed existing service levels.

"In fact, the new environmental regulations will indeed have a huge impact," Shi Soren said at Maersk's second-quarter earnings conference yesterday. "Considering the shortage and expensiveness of green fuel, slowing down will be the most likely option for shipping companies. The "most likely" compliance option.

According to Danaos, the company has 71 container ships, all of which have been chartered this year, and the charter period of its fleet in 2023 is also locked in 80%, with the current average charter period reaching 3.6 years.

The company reported revenue of $251 million in the second quarter of this year, compared with $146 million in the same period in 2021, and net income of $157 million, compared with $69 million previously.

"Given our time charter coverage over the next 12 months, we expect these metrics to improve further. However, at the same time, we are closely monitoring macroeconomic conditions and the potential impact on our industry," Coustas said. Dr. said.

Previous:There is a mystery behind the data! Port of Rotterdam data release for the first half of 2022

Next:Maersk Announces New Acquisition! Strengthen project logistics service capabilities