2021 list of the top 10 retail e-commerce companies in the U.S. released

The list of US retail e-commerce companies is released. Who will take advantage of the trend and who will experience the downturn?

2021 list of top 10 retail e-commerce companies in the U.S. released 2021 list of top 10 retail e-commerce companies in U.S. released

eMarketer released a list of the top 10 retail e-commerce companies in the United States in 2021, and made predictions on the sales trends of major e-commerce companies in the U.S. before and after the 2020 epidemic and in 2021. (EMarketer's list of the top 10 retail e-commerce companies in the United States is updated every six months. The most recent updates were in February 2020, September 2020, and February 2021.)

Compared with the forecast before the outbreak in February 2020, Best Buy is expected to rise from No. 7 to No. 5 in 2021, Target will rise from No. 8 to No. 6, and Kroger will rise to No. 8 by the end of 2021. Bit. Home Depot will drop from No. 5 to No. 7, Wayfair will drop from No. 6 to No. 10, and Macy’s will drop out of the top 10. Apple and Costco will hold fourth and ninth positions respectively.

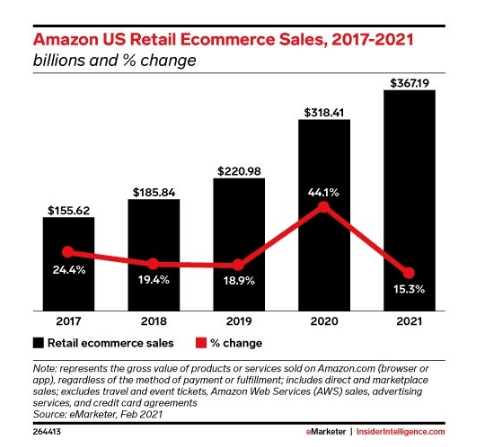

Amazon

In 2021, Amazon will hold onto its momentum and secure its position as the leading electronic retailer in the United States:

According to estimates before the outbreak, Amazon’s sales in the United States will reach 260.86 billion U.S. dollars in 2020, accounting for 38.7% of U.S. e-commerce sales.

After the outbreak of the epidemic, the forecast was revised. It is estimated that Amazon's sales in the United States will reach 318.41 billion U.S. dollars in 2020, accounting for 39.8% of total e-commerce sales.

It is estimated that in 2021, Amazon's e-commerce sales in the United States will reach 367.19 billion U.S. dollars, accounting for 40.4% of the total U.S. e-commerce sales, and its market share will increase again.

shipping forwarder china

Amazon's forward-looking investments in delivery speed, delivery services and online groceries have laid the foundation for the company's success during the epidemic. Amazon has a large share of the growing online grocery market through Amazon Fresh and Whole Foods. In addition, small and medium-sized enterprises rely more on e-commerce sales, which means that Amazon's huge third-party supplier market will further promote sales growth. It is estimated that by 2021, Amazon's sales in the United States will increase by 16.5% to $220.39 billion, accounting for 60.0% of Amazon's total sales of e-commerce in the United States.

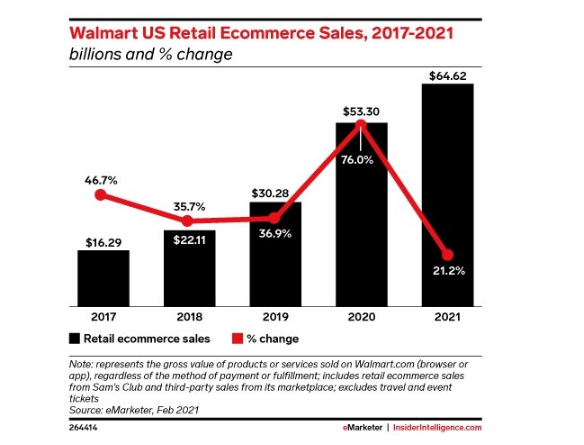

Walmart

Wal-Mart will become the second largest electronics seller this year:

Before the outbreak, Wal-Mart’s e-commerce sales in the U.S. are expected to increase by 27.0% in 2020, reaching US$35.86 billion.

The epidemic has boosted Wal-Mart’s e-commerce business in the United States to grow by 76.0%, with sales of 5.33 billion U.S. dollars, accounting for 6.7% of total U.S. e-commerce sales.

This year, Wal-Mart’s U.S. e-commerce sales will account for 7.1% of total sales, which will further widen the gap with its rival eBay, but this value is less than one-fifth of Amazon.

Wal-Mart uses its huge physical store strength to promote e-commerce sales through "online shopping and offline pickup". In 2020, Walmart launched new initiatives, such as the logistics service Walmart Express Delivery, which provides a 2-hour delivery service for groceries and other items, and a prime-like subscription service Walmart+, which provides members with unlimited free shipping and other benefits. Wal-Mart’s earnings report for the fourth quarter of 2020 shows that its e-commerce business has achieved the highest quarterly growth rate in the year. Doug McMillon, President and CEO of Wal-Mart, said that Wal-Mart will use this momentum to accelerate investment in the digital field. "We will use our growing logistics capabilities to improve customer experience and develop the market, and build our logistics service business."

shipping forwarder china

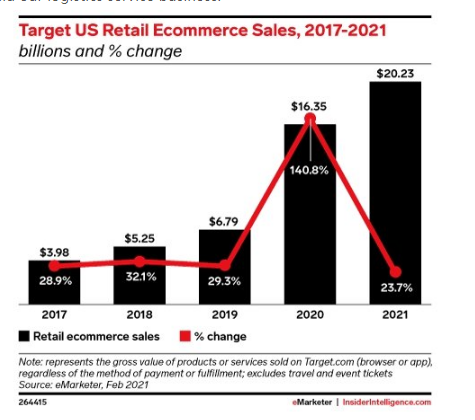

Target

This year, Target’s e-commerce sales growth rate will be at the top of the list:

Long before the outbreak of the epidemic, Target had already set out to develop e-commerce business. According to estimates before the epidemic, Target’s e-commerce growth will reach 24.0% in 2020, and its sales in the United States will reach 8.34 billion U.S. dollars.

The epidemic has promoted rapid economic growth. After the epidemic, it is estimated that Target's e-commerce business will increase by 140.8% in 2020 to reach 16.35 billion US dollars.

Target has risen from No. 8 on the e-commerce forecast list (forecast in February 2020) to No. 7 (updated in September 2020). In 2021, Target’s sales in the United States are expected to increase by 23.7%, reaching US$20.23 billion, ranking sixth.

Target learns from Wal-Mart's gameplay, uses physical stores to promote "online shopping, offline delivery" services, and invests in the field of online groceries, and cooperates with Shipt. At the Investor Day online event in March 2021, Target announced that it will invest billions of dollars in the next few years to fulfill online orders more efficiently, and plans to open 5 in major urban centers in 2021. New warehouse.

shipping forwarder china

Affected by the epidemic, more and more consumers choose to purchase daily necessities online. The products sold by Target belong to the three fastest-growing vertical markets in the e-commerce sector this year: clothing, food and beverages, and health and personal care products. Companies such as Best Buy and Home Depot mainly sell products in a single vertical. Target The advantages are self-evident. However, Target needs to compete with Amazon and Walmart for the sale of online groceries and other daily necessities, but Target’s website is much smaller than Amazon and Walmart, and the number of physical stores cannot match Walmart (Walmart has about 4,743 stores in the US , And Target has only 1904.), which makes it more difficult for Target to get a larger share of "online shopping, offline pickup" sales.

Best Buy and Home Depot

The sales of these two retailers in 2020 are larger than expected before the epidemic.

Affected by people working and studying at home, the demand for consumer electronics products will soar in 2020. It is estimated that Best Buy’s e-commerce business in the United States increased by 135.6% last year, creating sales of US$18 billion and rising to No. 5 on the list.

The epidemic has also aroused the interest of homeowners in DIY and home improvement, so Home Depot has also achieved gratifying revenue in 2020, creating US$17.69 billion in U.S. e-commerce sales, an increase of 81.2% year-on-year. But Best Buy grew faster, pushing Home Depot out of the top 5.

As the epidemic subsides, demand for electronic products and home improvement will decrease, and sales of Best Buy and Home Depot will cool in 2021. However, Best Buy’s momentum will keep it in the top 5, with e-commerce sales in the US reaching US$20.34 billion in 2021, an increase of 13.0%. Home Depot is expected to grow 13.2% to reach US$20.02 billion, ranking seventh.

shipping forwarder china

Kroger and Costco

Kroger and Costco account for a small proportion of total e-commerce sales, but the booming online grocery shopping will make Costco and Kroger the third and fourth fastest-growing e-commerce companies in 2021, respectively.

Before the epidemic, Costco's US e-commerce business is expected to grow by 19.0% in 2020, reaching sales of 8.33 billion U.S. dollars, while Kroger is not expected to enter the top 10.

However, the surge in demand for online groceries in 2020 has caused Costco's US sales to increase by 75.4% to 12.23 billion U.S. dollars, while Kroger's e-commerce sales increased by 103.1% to 12.76 billion U.S. dollars.

Costco's U.S. e-commerce sales this year will increase by 19.2%, reaching 14.58 billion U.S. dollars, ranking 9th on the list. Kroger will grow by 17.8%, reaching 15.04 billion US dollars, ranking eighth.

The key digital strategy for these two companies is to work with technology companies and make the most of physical stores.

Kroger started investing in online groceries a few years ago. In 2018, it cooperated with British technology company Ocado to use automation and artificial intelligence to complete online grocery orders more efficiently. Kroger claims that its pickup and delivery service has covered 98% of its customers and is currently expanding its cooperation with Ocado to build more distribution centers and launch in-store order fulfillment technology.

Costco and Instacart have maintained a cooperative relationship for many years. Recently, on the basis of the same-day delivery service, Costco has added the "online shopping, offline pickup" service.

Macy's

Compared with the increasing demand for products such as groceries, personal care and consumer electronics, the demand for clothing and accessories in 2020 is slightly sluggish. Therefore, in the September 2020 update, Macy's dropped out of the top 10 list. However, the performance of Macy’s was indeed better than expected before the epidemic, with an increase of 31.0% in 2020 and e-commerce sales in the United States reaching US$8.14 billion. But in the top ten, all companies except eBay are growing faster than Macy's.

In 2021, as consumers gradually come out of the epidemic, demand for clothing and accessories will resume. However, it will be difficult for Macy's to rebound back to the top 10. U.S. e-commerce sales of Macy’s are expected to increase by 9.0% to US$8.87 billion. In contrast, Amazon's clothing and accessories business is expected to grow by 21.4%, reaching US$58.75 billion in U.S. e-commerce sales.

shipping forwarder china