The most common fine is heavy. I have seen three sellers who have been fined more than 500,000 U.S. dollars in taxes, and even sellers who have been fined more than one million U.S. dollars in taxes. What are their mistakes? It is the 1099 form.

cheap freight from china

Amazon will record all the seller's sales, and then give you how much money, if you use an account opened by a US company, it will send these data to the US tax bureau every year.

However, many sellers do not have a bank in the United States themselves, thinking that the tax bureau will not know, and they will make zero declarations, or the sales amount is inconsistent with the actual data known by the tax bureau, so the tax bureau can easily find out.

For example, if you sell 1 million US dollars of goods and make a zero declaration, the tax bureau will treat the 1 million as profit after discovering it. At least you will have to charge your federal income tax of 210,000 plus fines and the like. Is very serious.

I have seen two to three such cases, and traced back to 2015 and 2013. It does not mean that you can forget the past three years. If the tax bureau suspects that you have deliberately evaded taxes, it can be investigated indefinitely.

cheap freight from china

Therefore, cross-border e-commerce must pay special attention to this point. Go to the back office of Amazon and eBay, it should be said that it is the back office of PayPal, and the back office of all collections. Check the sales amount they send to the tax bureau, and then report to the IRS. File a 1099 form for tax return to avoid heavy fines.

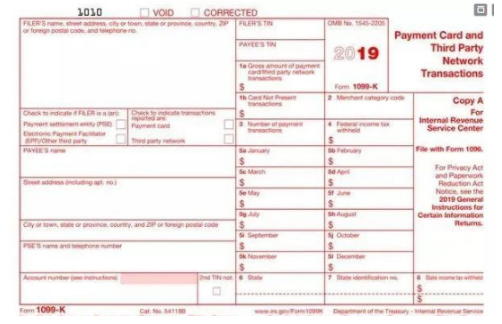

And 1099 has two forms, the first is 1099K.

The 1099K form is a tax form used by credit card and other payment and collection companies to record the amount of collection and payment for US companies or individual sellers each year. As long as the seller’s transactions exceed 200 times or US$20,000 within a year, the collection and payment companies such as PayPal , Amazon Payment, etc., will generate a sub-tax form, one for the seller, one for the tax bureau, and one for your own preservation.

cheap freight from china

I want to reiterate here that regardless of whether the payment is eventually remitted to a bank in the United States, the collection and payment company will report the actual amount collected and paid to the U.S. Taxation Bureau. Therefore, when you apply for a US company and use the company tax number to register a platform account, the sales generated by the US Tax Office are clear.

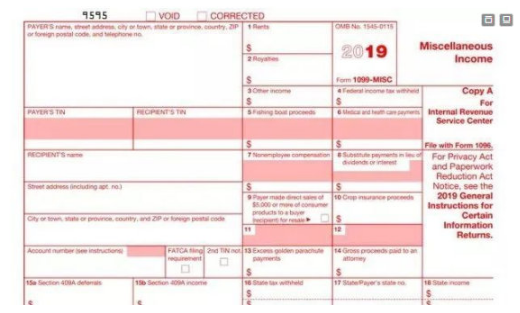

The other is 1099-MISC.

This form is generally issued by a company to a personal service provider to record the service fee paid by the company to the service provider within a year, and the tax withheld and other information.

cheap freight from china