A 7% increase in fees across the board? ! Is Amazon's new policy confusing to raise costs by 7% across the board? ! Amazon's new policy is confusing

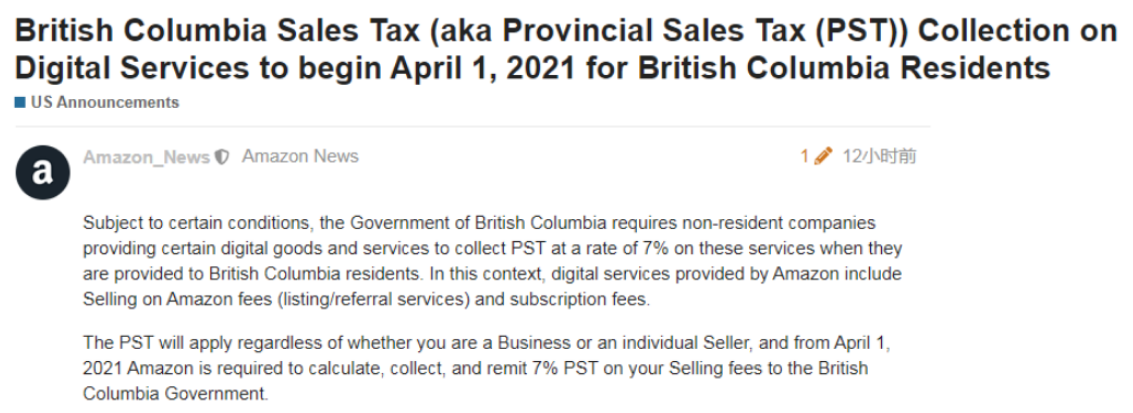

Today, Amazon updated a new notice in the background, saying that at the request of the British Columbia government, Amazon will collect 7% digital service tax on sales commissions, platform monthly rent and other services from April 1, 2021. !

china freight

Taxation of services is quite common, and the digital tax of 2%-3% currently implemented in Europe is one of them. Including Amazon’s sales points and monthly platform rents, it will increase in proportion to the tax point. For example, the original sales commission was 15%, and after a 3% increase, it became 15.45%.

So this time, the digital tax in Canada is the same as in Europe, and the digital tax is imposed on all Canadian sellers, which is equivalent to a 7% increase in all service fees?

It is not a general increase but is conditional. The announcement stated that this policy change was collected in accordance with the new tax law of British Columbia (hereinafter referred to as BC) in Canada. If it is an order consumption tax that can be understood, it will directly be sold to this The province’s orders are taxed, so how to define the commission tax and platform monthly tax? You can’t just increase the commission for the whole store as long as you sell it to BC.

Many American sellers are also very confused about this statement. Amazon's announcement is not clear. Which sellers should bear this cost? In the official forum, you can see a lot of sellers questioning.

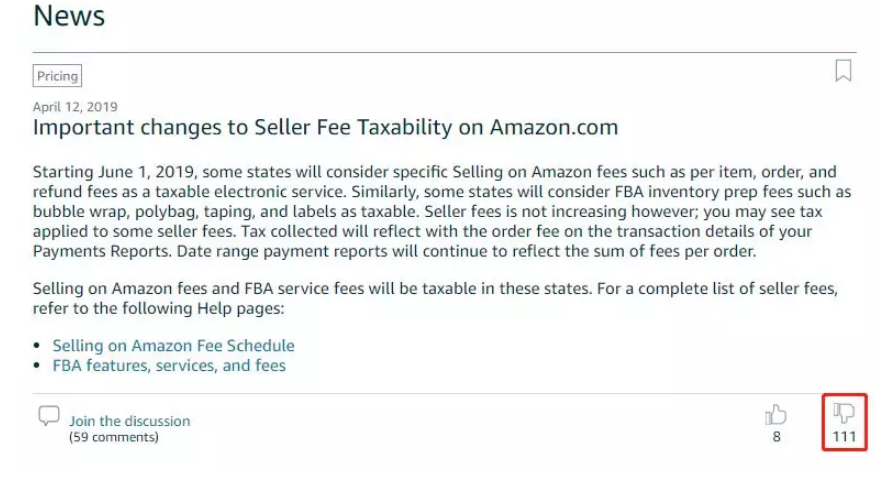

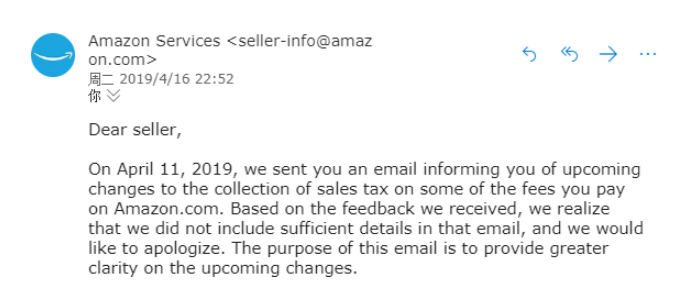

In fact, Amazon has had a similar policy before, and even being scolded for failing to make it clear is highly consistent with this recent time. In 19 years, Amazon America announced that it would levy taxes and fees for several specific state governments. As in this case, the levy is also for sales commissions, platform monthly rents and other services.

china freight

However, Amazon's statement in the announcement is very vague, how to charge, what the tax rate is, and it doesn't mention what kind of taxation should be paid. For this reason, a large number of negative feedbacks from sellers have been attracted. You can see how speechless the sellers were about this announcement at the time. Even because of the high level of scolding, Amazon finally had to send a group of apology emails and explained the main questions above in detail.

The same is the consumption tax of the regional government. This time, the tax collection in BC, Canada should be the same in terms of links. Now I will tell you in detail what the taxation law is.

Under what circumstances may be taxed?

First of all, the object of tax collection is the service provided by Amazon to sellers, which mainly includes the following two categories.

china freight

The difference between these two types of fees is that the fees in the left column are the fees for online services, while the right column is the fees for operating in the FBA warehouse (note that warehousing and logistics fees are not included). These two types of fees are subject to digital consumption tax, which is the 7% increase in Amazon's new policies in BC this time.

Although the rate of increase is the same, the two columns of fees are taxed differently. Only local sellers in BC need to pay the consumption tax on online services in the left column. Our Chinese sellers do not need to pay taxes on these fees unless the company address is locally registered in BC, Canada.

The column on the right is different from FBA-related miscellaneous fees. The fee collection standard for this column is that as long as the local FBA warehouse in BC is used, tax is required when these fees are incurred, whether it is a local seller or not.

While there are very few local FBA warehouses in Canada, the number of warehouses located in BC is very large, including YVR1, YVR2, YVR3 and YVR4, occupying half of the local FBA warehouses in Canada. If your products are stored in these warehouses, you should pay attention to it. Starting from April 1st, you may have to pay taxes for the FBA miscellaneous fees in the right column.

Although the cost is not much, the seller's consumption tax on the Canadian station needs to be declared by the seller itself, rather than automatically withheld like the US station. If the seller does not operate properly, the seller may be found and be required to pay the tax. Therefore, sellers who have FBA inventory in Canada must pay attention to this new policy!

china freight