The market value of the fast fashion industry in the United States can reach billions of dollars. Even when economic development is uncertain, Americans will continue to buy. So, what kind of products will consumers come to? What impact does consumer decision have on fast fashion retailers?

In recent years, the development of fast fashion retailers with a large number of clothing and rapid inventory turnover has become a hot topic after people's tea.

CIVIC Science has in -depth research on market data to understand the trend of fast and fashionable consumer market in 2023.

• 42%of generations Z -generation adult group frequently buy fast fashion products

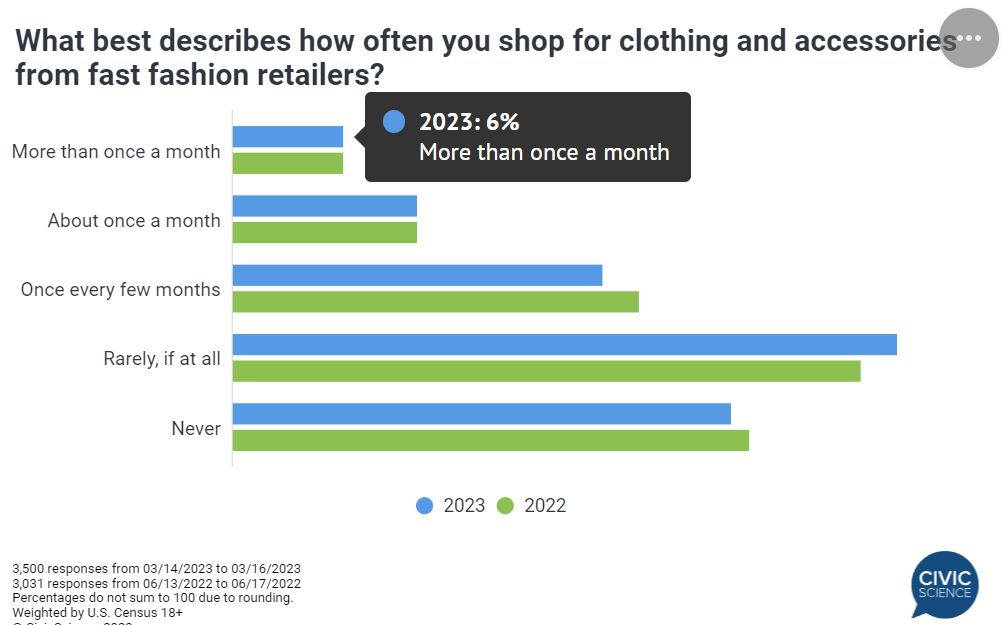

Data show that since 2022, the percentage of people who buy fast fashion products in the United States have stabilized at least 16%in the past at least once. People still buy fast fashion products. shipping forwarder

Consumer groups that promote fast fashion trends are mainly women and generations of generations from generation to generation. Among them, 19%of female consumers conduct fast fashion products per week or monthly, while the proportion of adults in generations is 42%.

Frequent fast fashion consumers are more likely to give priority to comfort and fashion. They are greatly affected by social media and are also interested in fast fashion brands such as Shein, ZARA, H & M.

• Who will ask for the fast fashion industry?

Emerging Fashion Retail Giants SHEIN and e -commerce platform TEMU are mainly low -cost strategies. Data show that for consumers who frequently buy fast fashion products, although they can buy multiple clothing at a low price at a low price, the price is not the only key factors they consider.

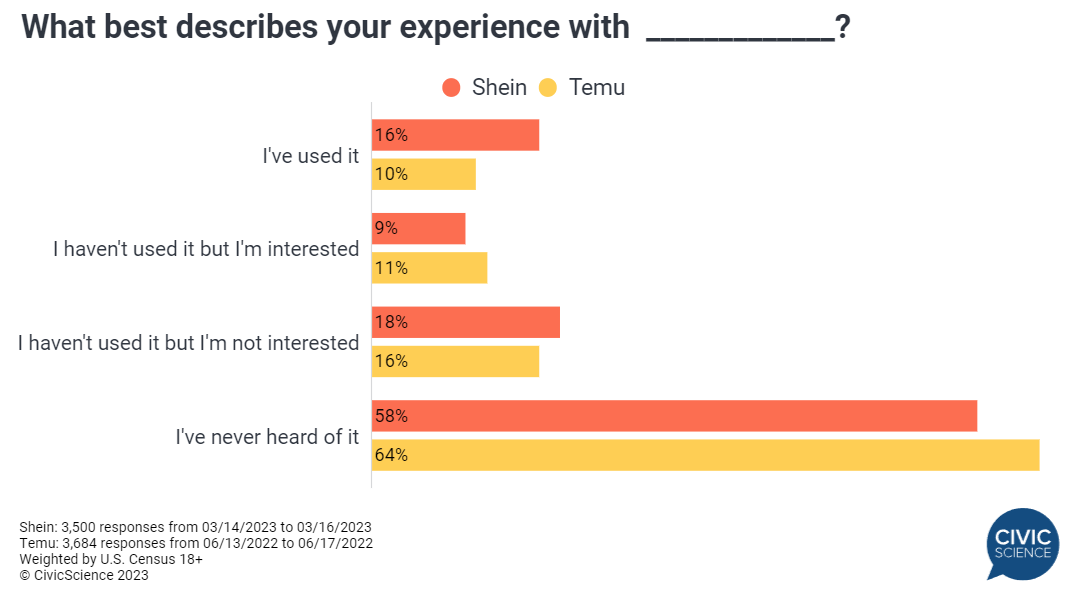

At present, SHEIN and TEMU's two companies are still developing in the US market. 16%of American interviewees have used Shein, and 10%of the respondents have also used TEMU. Of the American interviewees who have not used these two platforms, 11%of the respondents are more interested in TEMU, because they not only sell high -cost fast fashion clothing, but also a multi -category e -commerce similar to Amazon e -commerce platform.

At the same time, young people (40%) and women (20%) from generation to generations from generation to the age of 18 to 24 have once again become the main consumer army of Shein and TEMU. In addition, more than 30%of Tiktok users have a shopping experience in Shein, and 28%of Tiktok users are more interested in the platform.

At present, more than 50%of American adults do not like to buy second -hand clothing from online channels. However, fast fashion consumers who buy second -hand clothing online, which shows that the newly launched resale programs for Thredup and H & M brands still have certain development potential. freight to USA

• Amazon's home advantage in the United States still exists

In the ranking of consumers' favorability of retailers, the retail giant Amazon ranks among the best among clothing retailers. Old Navy follows closely. Furthermore is Tagit, Wal -Mart, ASOS, GAP, H & M, Zara, Urban Outfitters. And Forever 21.

Of course, the favorability of the market does not represent everything. For example, although 42%of women like to buy clothing on Amazon, only 34%of men hold the same view. The consumption preferences of bisexuals on platforms such as ASOS, Zara, and Urban Outfitters are also similar to Amazon's situation.

Previous:How do cross -border sellers screen high -quality suppliers?

Next:The cross -border market "soaring" recovers. In 2026, Europe may exceed 1.1 trillion US do