In January of this year, Amazon began to collect and pay the VAT tax on the British site. The 20% tax rate has made many sellers feel painful and worried that other sites in Europe will follow up.

In the latest news, Amazon has sent an email notification to sellers: starting from July 1, 27 EU countries/regions will implement new VAT regulations, and Amazon will collect and pay on their behalf.

27 EU countries will implement new regulations, Amazon collects and remits VAT

Yesterday evening, some Amazon sellers received an email titled "Notice for EU e-commerce VAT changes starting from July 1, 2021." Amazon stated in an email that from July 1, 2021, 27 EU countries/regions will implement new value-added tax rules on e-commerce sales, which will have an impact on sellers selling products to EU consumers through online stores such as Amazon. .

shipping directly to amazon fba from china

The important changes mentioned in the email include, from July 1, 2021:

1. In these situations, Amazon needs to collect and pay value-added tax for the seller's B2C product sales on the platform:

1) The goods are sent from the EU address to the EU buyer, but your (sales partner) company registered address is not in the EU;

2) The goods are directly sent from non-EU addresses to EU buyers, and the value of the shipment does not exceed €150. These shipments are subject to specific customs declaration and labeling requirements.

2. Imported small parcels with a value not exceeding €22 will no longer be exempt from VAT. From July 1, 2021, all imported e-commerce packages are subject to VAT regardless of their value.

3. The existing threshold for distance sales within the EU will be abandoned, and the new threshold is €10,000, which applies to the entire EU. This does not apply to sales made outside the country/region where your company's registered address is located, nor does it apply to sales where Amazon is required to collect and pay VAT.

4. The European Union will introduce an optional VAT declaration procedure called "Union One Stop Shop" ("Union-OSS"). With this simplified declaration procedure, sales partners with company registered addresses in the EU can uniformly declare value-added tax for their remote sales across the EU in their member states.

Sellers should note that these changes will not affect the sales or distribution of goods to EU B2B buyers. In such sales, the current EU VAT declaration requirements will continue to apply. Sellers still need to meet the VAT registration requirements of the EU countries/regions in which they hold inventory.

The European Union began to collect value-added tax, and most European sellers directly faced a 20% increase in cost. I deeply feel Alexandria.

The EU tax rate is generally 20%, how much do sellers want to adjust the price?

The 27 EU countries include:

France, Germany, Italy, Spain, Austria, Belgium, Croatia, Luxembourg, Bulgaria, Cyprus, Czech Republic, Denmark, Estonia, Finland, Greece, Hungary, Iceland, Latvia, Lithuania, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Sweden.

Among them, France, Germany, Italy, Spain, and the Netherlands are all the markets where the Amazon site is located, and they are also the strongest force for sellers on the European site. The standard tax rates of Germany, France, Italy and West are 19%, 20%, 22%, and 21% respectively. The standard VAT rate of 21% is applicable in the Netherlands.

When notifying the payment of VAT on the UK site, Amazon reminded the seller to increase the price and include the VAT tax in the product price. Many sellers have previously reported 0 or used a low tax rate of 6.5%-7.5%. After Amazon withholds, these sellers will have to increase their prices by about 10%-16% to be equal to their previous profits.

Nowadays, sellers are also facing the choice of price adjustment. However, just like the British station, most sellers will choose not to adjust the price, and the sellers who boldly adjust the price will be affected. They can only adjust the original price again to absorb the extra tax.

shipping directly to amazon fba from china

The number of new sellers has surpassed Meiya, and the prices of local European accounts have risen.

Affected by this incident, the prices of local European accounts may usher in a wave of price increases.

Yesterday, after receiving an email from Amazon for paying EU VAT, some sellers said that a wave of local European accounts would be born.

It is understood that EU companies do not need to be paid and withheld VAT. If a seller establishes a company in an EU country, and then registers and operates an account, it can generate about 20% more profits.

Under the weight of VAT, some sellers may use local European accounts to keep their profits, and the prices of local accounts will surely rise.

Sellers in the industry make inquiries. The cost of a local European account is not small. The registration cost for a German company is about 200,000 yuan, and a French company needs 50,000 yuan. This cost discourages most small and medium sellers.

After the account is registered, there will be some postcard reviews, kyc reviews, etc. Many domestic sellers do not want to register for a local account, but their strength may not allow it. But the European local account will inevitably become a sweet potato.

Most domestic sellers who do not have a local European account will inevitably be affected by the payment. In addition to the U.S. site, Amazon's European site is also an important destination for Chinese sellers' Nuggets. Local e-commerce has high penetration and stable sales growth, such as the top sellers of SHEIN and Anke. Last year, nearly 60% of Aosen's revenue came from Europe, and 70% of the revenue of the top sellers came from four sites in Britain, Germany, France, and Italy.

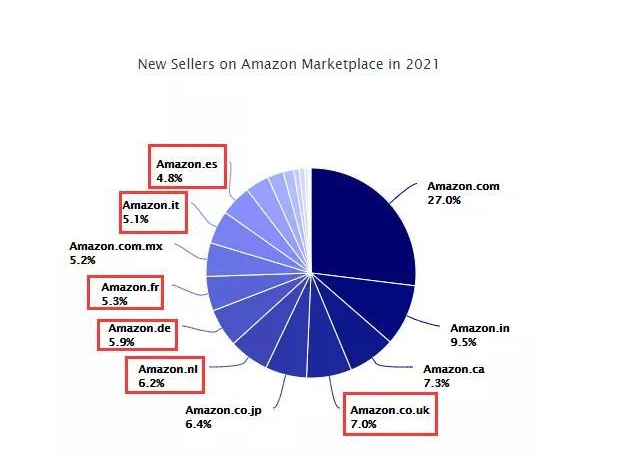

Data shows that, so far this year, 331,000 new sellers have joined the Amazon market, which is equivalent to 3,491 sellers per day, 145 sellers per hour, and 2 sellers per minute. At the current rate, 1.3 million new sellers will join Amazon by the end of this year.

Among all the new sellers who have settled on Amazon this year, about 35% of sellers have joined several important European sites such as the UK, Germany, France, and the Netherlands. The proportion of new sellers in these European countries has surpassed that of Amazon America.

shipping directly to amazon fba from china

The European market has gradually become active. Following Amazon's UK, German, French, Italian, Spanish, and Dutch sites, Amazon has also established a Polish site in Europe to further attract consumers and invite more sellers to settle in.

Data in late March shows that Amazon Europe has attracted about 115,000 new sellers this year. Most of these new sellers have joined Amazon's markets in the UK, the Netherlands and Germany. If this trend continues, the European market will welcome more than 500,000 sellers by the end of this year.

With such a large number of European sellers, Amazon's payment of EU VAT will have a greater impact on European sellers.

eBay has previously issued a notice of EU collection and collection of VAT

In addition, eBay has also issued a notice of EU collection and payment of VAT.

eBay informs sellers that starting from July 1, 2021, the EU will make major changes to the VAT collection methods for goods imported into the EU, non-EU sellers in the EU, and EU sellers on cross-border sales of goods in the EU.

The changes include the following:

The EU will abolish the current VAT exemption for all low-value goods imported into the EU with a value of no more than 22 euros.

For goods imported into the EU and sold to EU consumers with a value of no more than 150 euros, eBay will collect value-added tax on the goods in accordance with the requirements of the relevant EU tax authorities.

For sellers who are not EU companies whose goods have been stored in the EU in advance and sold to consumers in the EU or sold from one EU country to another EU country, eBay will collect and pay VAT on their behalf according to the requirements of the relevant EU tax authorities.

All sellers will have to provide the tax-inclusive price of their articles and provide a separate VAT rate so that eBay can determine the correct VAT amount to be collected.

For sales on any platform, EU compliance is imperative!

shipping directly to amazon fba from china